SBI Mobile Banking

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Mobile banking has indeed simplified our financial chores by providing most of the banking-related services on mobile devices. The arrival of mobile banking has made banking processes like money transfers, payments, deposits, balance inquiries, etc. possible from the comfort of our homes.

State Bank of India's mobile banking services, known as State Bank FreedoM, enables the customers to enjoy banking anytime, anywhere. State Bank of India's mobile banking can be used on their phones using a mobile application or WAP. A customer must use an Android or iPhone device, or have a java enabled phone. You must download the application from the App market or Play store on your phone and then sign up to start using State Bank FreedoM.

Savings account holders in the P segment and current account holders in the P and the SME segments, are allowed to use this facility. Any telecom service provider can be used to avail of this service. This service has no additional charges apart from the data and SMS costs. The transaction limit is Rs.50,000 daily and Rs.2,50,000 monthly using this service.

Features of SBI Mobile Banking

These are the amazing features that one can avail using SBI's mobile banking service:

- Cheque book request

- Balance inquiry

- Mini statement

- Opening deposit accounts

- Demat inquiry

- Funds transfer using IMPS, NEFT, RTGS, UPI

- DTH or mobile top-up

- Merchant payments

- Postpaid bill payments

- SBI Life Insurance premium

- ATM locator

- Branch locator

- Railway ticket booking

- SMS Banking - This is a form of mobile banking that works through SMS. One must first register for this service. The customer needs to enter the keyword corresponding to the service and send it via SMS to 9223440000 in order to use any particular service. SMS banking lets you recharge prepaid mobile or DTH, make IMPS Merchant payments, access Enquiry Services to get Mini Statement or conduct Balance Enquiry. The service is free, but SMS charges are to be borne by the user. The transaction limit for this service is Rs.1,000 daily and Rs.5,000 monthly. All the transactional messages must be deleted for safety purpose.

Features of SBI Mobile Banking

Account Related Information

You can avail the balance and transaction-related details and issue statement of account for a minimum of six months through email or via post.

Cheque Book Issue Request

You can issue a cheque book or cancel a cheque through phone banking

Transferring funds within SBI accounts

You can instantly transfer funds to other SBI Online accounts

Fund transfer between other accounts

You can transfer funds between other accounts.

Acquiring the interest certificate via post or email

You can acquire your interest certificate through post or email.

Acquiring TDS information

TDS inquiry is a facility for generating the details of tax deducted from your savings account in the previous financial year or the projected tax for the current financial year. You can acquire information linked with TDS with the help of SBI mobile banking

Bill Payments

You can make all your bill payments with the help of SBI mobile banking. Make payment for utility bills, insurance premiums, etc with SBI mobile banking and SBI Net Banking.

How To Register for SBI Anywhere Mobile App

- You can register for SBI mobile banking services at any SBI branches. You'll get a customer ID after you open a new account to register for mobile banking instantly.

- For using Mobile Banking on your smartphone, you can also refer to the official banking website. There is a simple procedure that you'll need to follow to use mobile banking:

- For procuring the User ID and MPIN, you merely need to send 'MBSREG' to 567676/9223440000 through your registered phone number

- You'll be given a User ID and default MPIN through SMS

- You can download the State Bank Anywhere application from play store if you're using an android device

- Log in with the details that you have received

- You can change your MPIN after logging in for the first time

SBI Fund Transfer

SBI allows various modes of fund transfer through its mobile banking feature:

NEFT

National Electronic Fund Transfer system or NEFT is a mode of electronic fund transfer that works on the basis of DNS or Deferred Net Settlement at specific times of the day. In NEFT, the transactions are carried out between banks via payment instructions. There is no set limit for NEFT transactions.

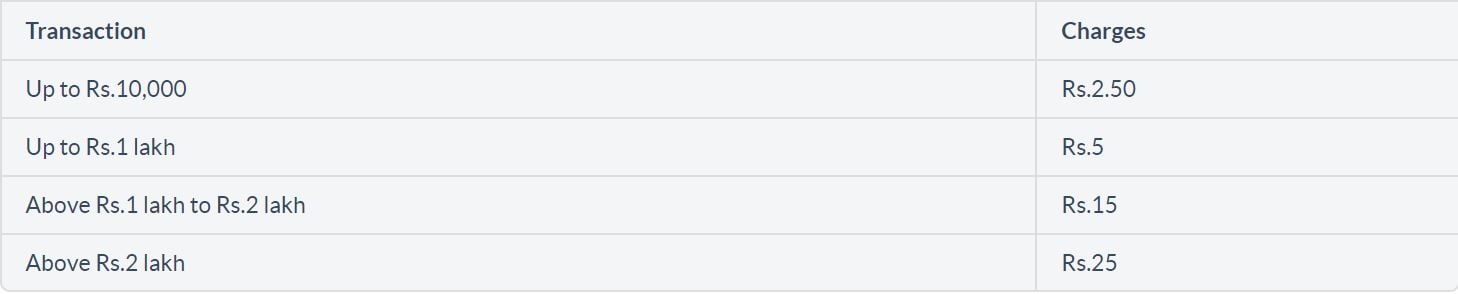

SBI NEFT Charges:

RTGS

Real Time Gross Settlement or RTGS transfer funds at the real-time, based on the received transfer instructions. The funds are individually settled as per instruction. RTGS happens to be the fastest way of interbank money transfer in our country.

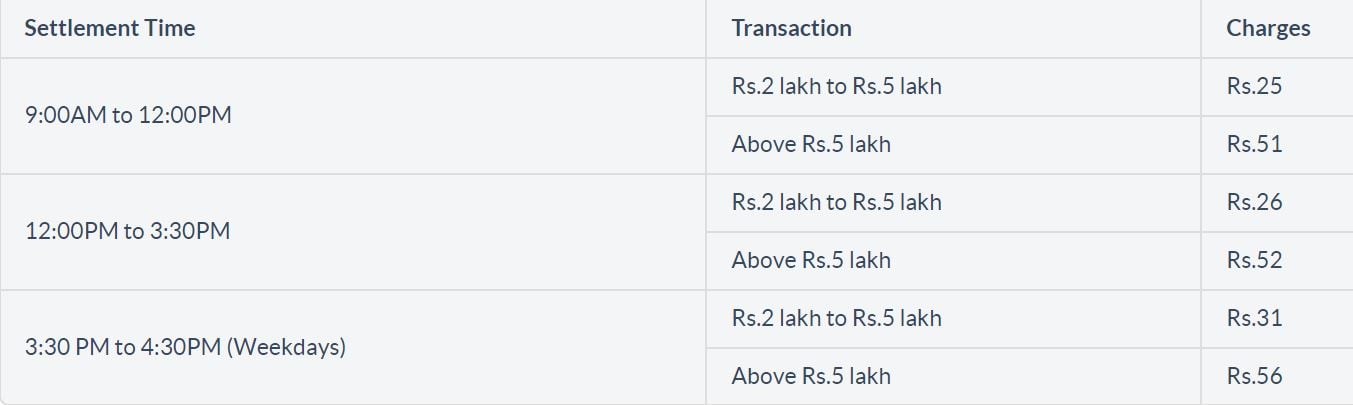

RTGS Timings and Charges:

IMPS

Immediate Payment Service, as the name suggests, is an instant way of electronic fund transfer. It is mainly used for inter-bank transactions. SBI provides the IMPS facility to all its customers who have registered for using online SBI services.

Benefits of Using SBI Mobile Banking

- State Bank FreedoM gives you the access to anytime-banking through your phone.

- This facility is available to all the customers of SBI with a savings or current account.

- SBI's Mobile Banking services are completely free of charges, except the SMS charges.

- It is extremely safe and secure.

- Innumerable services can be availed through State Bank FreedoM.

- These services can be availed through all teleservice providers.

SBI Mobile Banking: Security Measures

These are the security measures of the SBI mobile banking service:

- If your phone is ever misplaced or stolen, your account information remains safe as your information is neither saved on your SIM card nor your mobile phone. It is better to call the customer service to report the theft and deactivate your IPIN.

- If you enter an incorrect IPIN a number of times consecutively, the pin gets blocked by SBI.

SBI Mobile Banking: Do’s

- Secure your mobile phone with a unique password, which is not to be shared with anyone.

- Choose a strong password containing a mix of alphanumeric and special characters.

- Change your password frequently to ensure safety.

- Report the incident to the bank and the nearest police station without delay in case of theft or loss of your phone.

SBI Mobile Banking: Don’ts

- Mobile banking can be quite risky since you access these services while on the move. Do not hurry while entering the details.

- Don't share confidential information on any other website, except the registered bank’s app.

- Never share any banking-related information on your phone.

- If you happen to change your mobile number, you must inform the bank immediately.

- Avoid using mobile banking while on a public network.

SBI Mobile Banking FAQs

What is the primary benefit of SBI mobile banking?

The primary benefit of SBI mobile banking is that it can help you in carrying out all your banking transaction anywhere, anytime.

Who can request for this service?

SBI Bank mobile banking service is accessible by all SBI customers who have an active current or savings account. Currently, the mobile banking service is extended to SME customers as well.

Is it necessary to have an alphanumeric MPIN?

Having an alphanumeric MPIN ensures high-level security. So, it is advisable to keep an alphanumeric MPIN.

What is the count of characters maintained in MPIN?

The MPIN should be a total of six characters. You must it is a combination of special characters and alphanumeric.

If mobile banking isn't used for a more extended period, will the service get deactivated?

Yes, if mobile banking can't be accessed for six months, it gets deactivated automatically. People need to register again for availing the service.

®

®