YES BANK NET BANKING

About YES Bank

Yes Bank is India's 5th largest private sector bank, established in 2004 by Rana Kapoor. Yes bank is a "Full Service Commercial Bank", has relentlessly set up a corporate, retail and SME banking establishment, and has also proceeded to financial markets, investment banking, corporate finance, branch banking, business and transaction banking, and wealth management business lines.

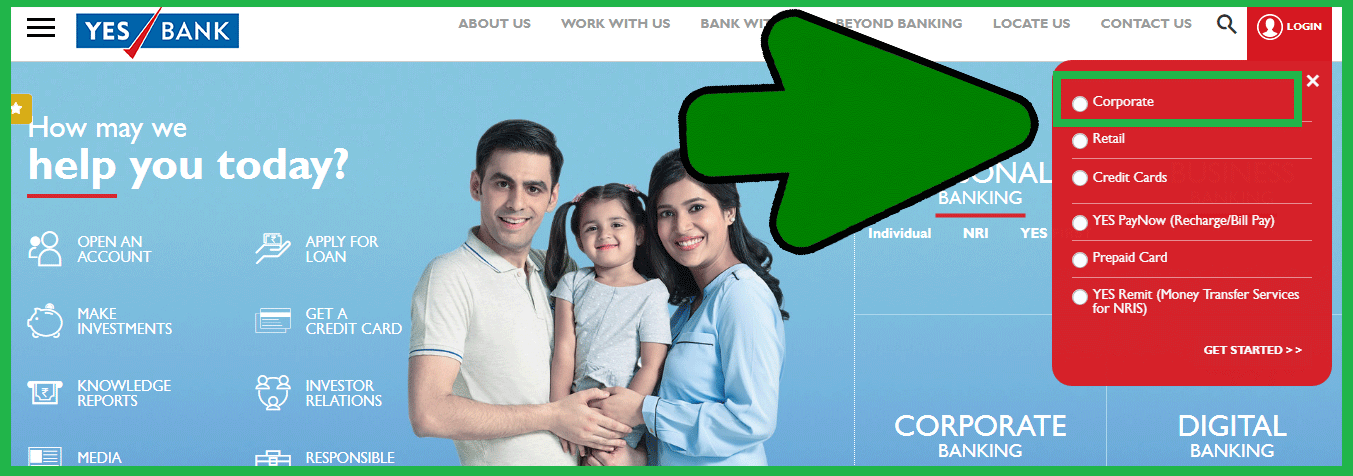

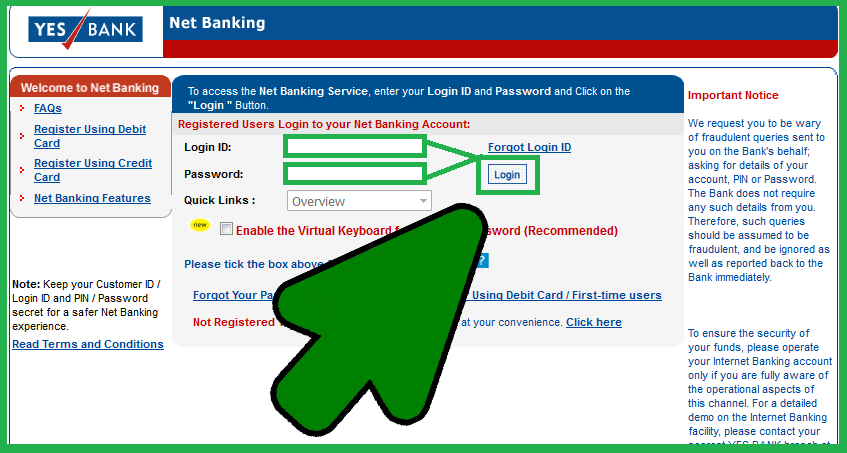

Steps to Login to YES Bank Online Banking

Follow these step-by-step guidelines to login safely to YES bank online banking web portal and start doing your transactions safely.

| https://www.yesbank.in/gateway |

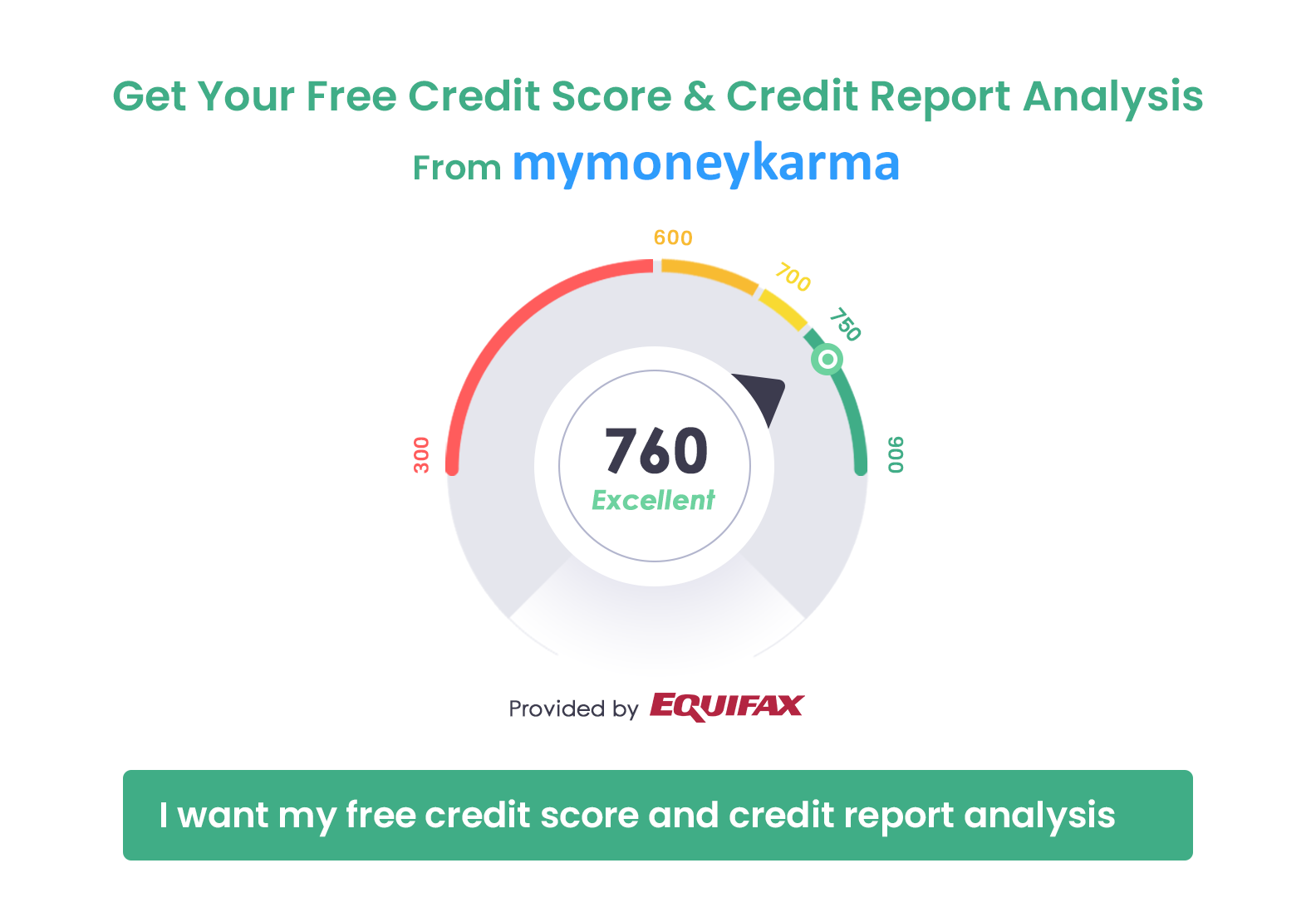

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Refer to the attached screenshot for further clarity

Points to note:

- Make sure that the website is secured by checking if the address bar contains "https://"

- Based on the type of customer you are, select either "Retail User Login" if you wish to access your savings account or "Corporate User Login" if you have a current or a company account.

After selecting the type of user, you need to enter your user name and password to access your online account.

Make your life easier!

FREE sign up with MyMoneyKarma today and view all your YES bank transactions in one place.

MyMoneyKarma helps you to view transactions from YES bank and many other banks safely and securely, with one simple login. Create a FREE account with MyMoneyKarma and manage your money effortlessly.

Happy Banking!