Car Loan EMI CALCULATOR: Monthly EMI for Car Loan in India

DATE

PRINCIPAL

INTEREST

BALANCE

What is an EMI?

Equated Monthly Installment (EMI) is the amount that you pay every month to the bank or any other financial institution for a loan that you have taken from that institution.

EMI comprises two components 1) the interest on the loan, 2) the portion of the principal amount to be repaid.

EMI is paid monthly, and it is a constant amount for the duration of the loan term. However, the part of the amount of the EMI that goes towards paying the interest and the principal changes over the tenure of the loan. As a rule of thumb, you will pay more principal with each subsequent EMI than what you paid in the previous EMI. Towards the last 25% of the EMI, you will pay a lot more principal than interest.

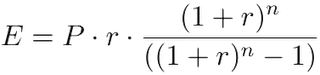

EMI is calculated by this basic formula:

where

E is EMI

P is the Principal Loan Amount

r is the rate of interest calculated on a monthly basis (i.e., r = Rate of Annual interest/12/100. If the rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is the loan term/tenure/duration in number of months

This looks complicated, doesn't it? Don't worry. You can use our EMI calculator to get the same result automatically without any hard work from your side. Not only do we automate the calculation, but we also show you graphs that help you understand your EMI better.

Why is mymoneykarma.com EMI Calculator Useful for You?

The mymoneykarma.com EMI calculator can help you in the following ways:

Calculate EMI in seconds our EMI calculator will help you calculate the exact EMI you will need to pay for your loan every month.

Assist you in planning your finances It lets you compare various options of EMIs by varying loan criteria of tenure, principal amount, and interest rate. The knowledge of all these options of EMI will help you choose the loan that is best suited for you.

Simplify calculations you must have already noticed that the formula for EMI calculation is extremely complex. However, to make the best decision, you might need to see the data in many different scenarios. Our calculator makes these calculations simple for you and helps you make an informed decision without getting into manual calculations.

How to Use mymoneykarma.com EMI Calculator?

With useful charts and automated results, mymoneykarma.com EMI Calculator is easy to use and very intuitive, making it quite easy for people to understand. You can calculate the EMI for any loan, including home loan (or housing loan), car loan (or auto loan), personal loan, and education loan.

To use the calculator, enter the following information in the EMI Calculator:

- The loan amount you wish to borrow

- The loan tenure (months or years that you want the loan for)

- The rate of interest (percentage at which you will get the loan)

You can either enter the values in the boxes or use the slider to input the values for all the parameters. Once you have entered the values, the calculator will automatically calculate the EMI amount for you.

The calculator also displays a pie chart that breaks up the total payment for the loan into principal and interest components of the amount paid; it displays the percentage and amount paid for the respective components. This information will help you figure out the cost of the loan you are taking and accordingly choose the option where you pay the least interest.

Why Use mymoneykarma.com Car Loan EMI Calculator?

We all love our new cars and often take loans to buy them. A car loan is a peculiar kind of a loan where you have to make two major decisions: first, which car to buy, and second, which car loan to opt for. Many of us spend a lot of time in deciding on a car model and subsequently negotiating with the dealers on the price and deals. However, what we miss out is getting into the details of the car loan that we are about to take from the lender for buying the car. We end up taking auto loans that cost us a lot more than they should, and the loan eats into the money saved by negotiating hard for a good deal on the car. While the logical action is to negotiate for both, we end up doing it only for the car as it is tangible and we can see it in front of us; we tend to ignore the loan.

Therefore, use the mymoneykarma.com car loan calculator to evaluate auto loan options before you finalize the one that is the best for you.