Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

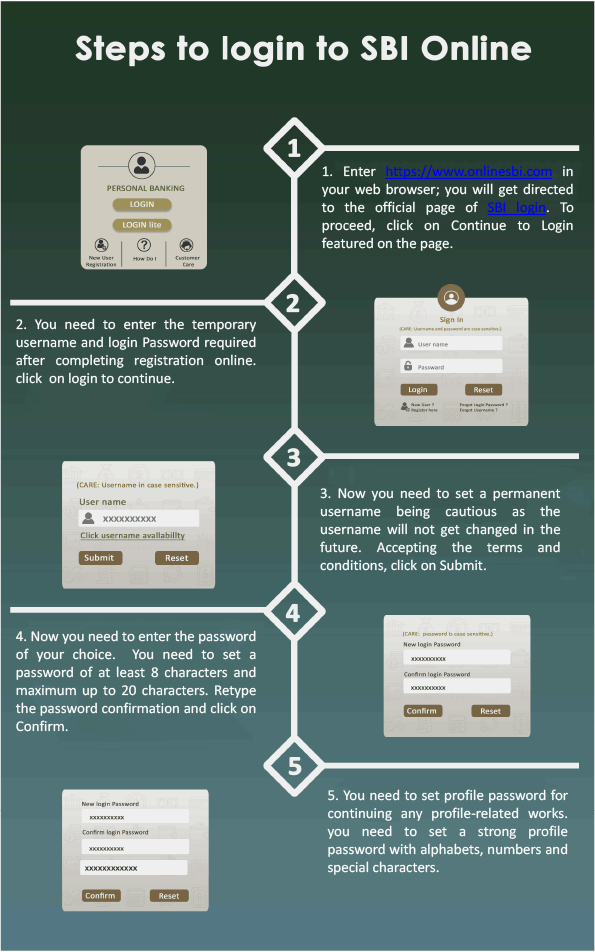

Follow these steps to login to SBI online

You can log in to SBI online by visiting the SBI Online login page and entering your id and password to access your accounts.

The roots of the State Bank of India lie in the first decade of the 19th century, when the Bank of Calcutta, later renamed as the Bank of Bengal, was established on 2nd June 1806. In pursuit of the provisions of the State Bank of India act of 1955, the Reserve Bank of India, which is India's Central Bank, acquired a controlling interest in the Imperial Bank of India. On 1st July 1955, the Imperial Bank of India became the State Bank of India. In 2008, the Government of India acquired the Reserve Bank of India's stake in SBI so as to remove any conflict of interest because the RBI is the country's banking regulatory authority.

In 1959, the government passed the State Bank of India (Subsidiary Banks) Act. This Act led to the formation of eight subsidiaries of SBI. Prior to their nationalization and operatonal take-over between September 1959 and October 1960, these subsidiaries belonged to the princely states. Later, in 2016, the operations of these subsidiaries or SBI associate banks were merged with SBI.

Steps to login to SBI Online

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

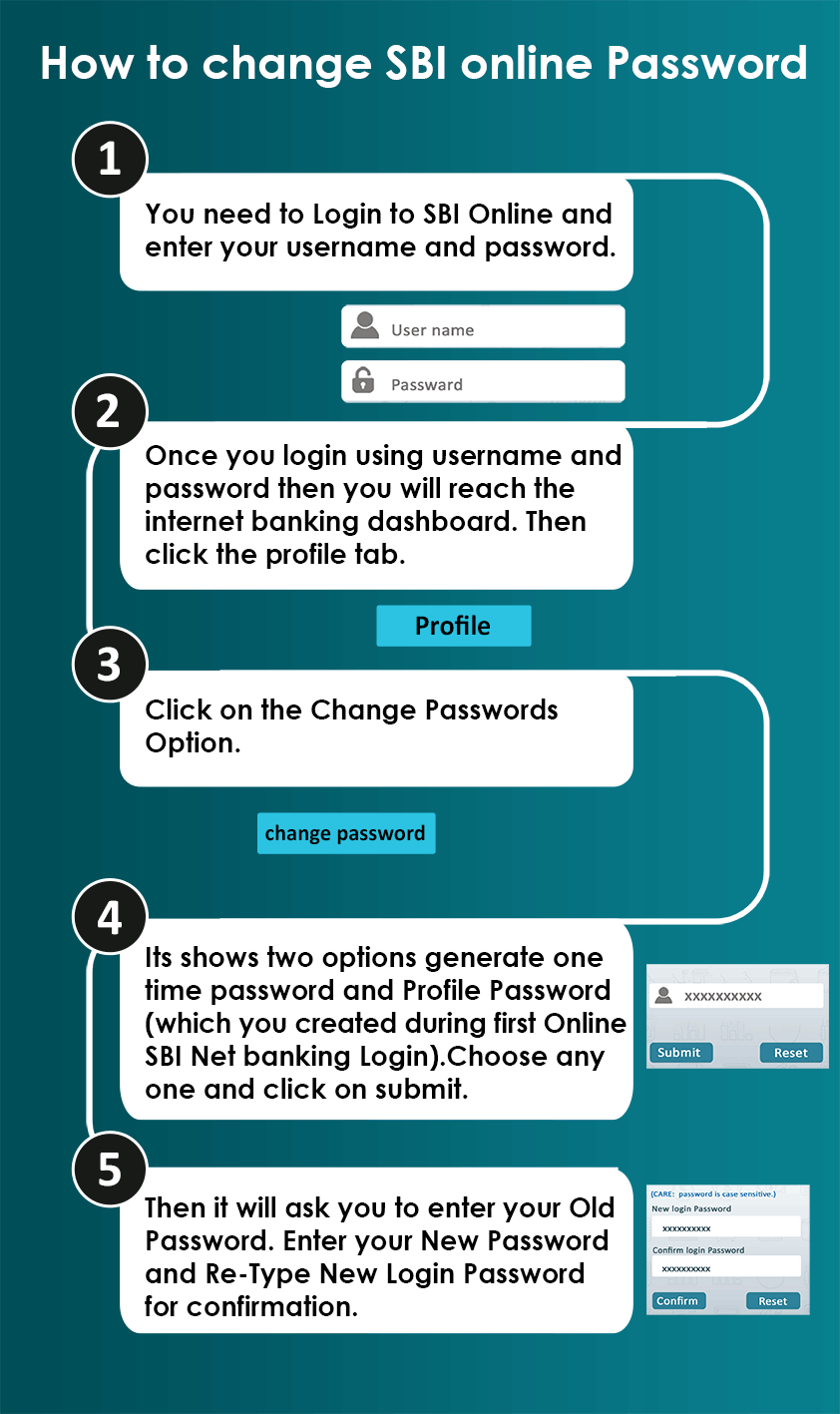

How to change SBI online Password

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

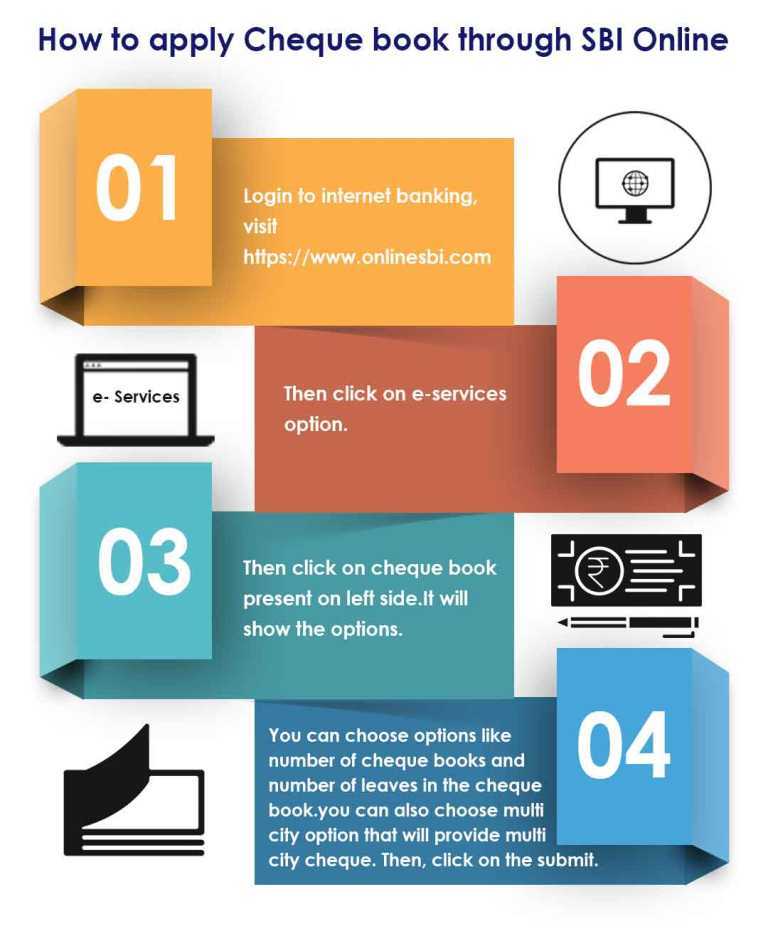

How to apply for Cheque book through SBI Online?

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

SBI Online Balance Enquiry

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

SBI Online Account Opening

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

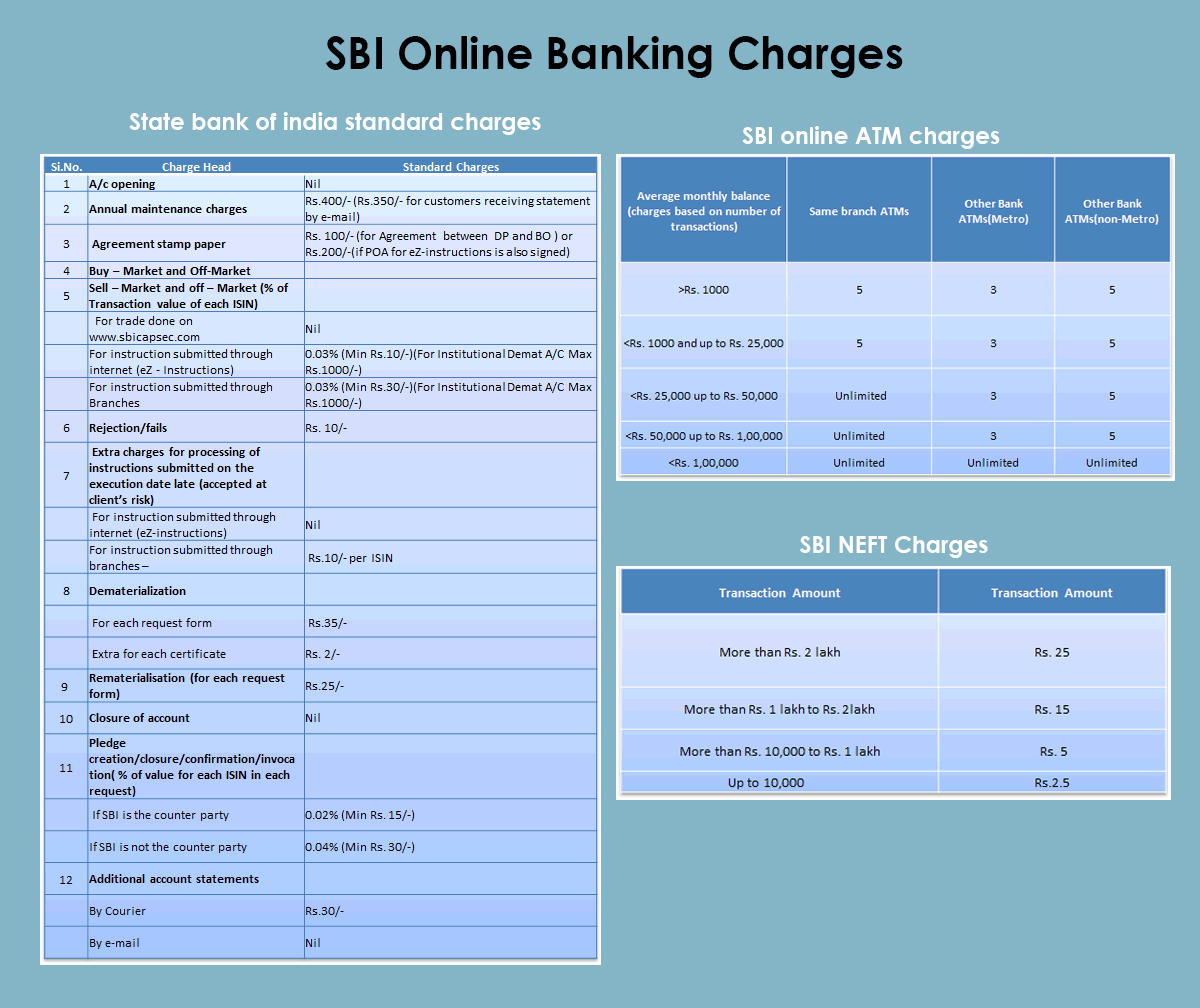

SBI Online Banking Charges

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

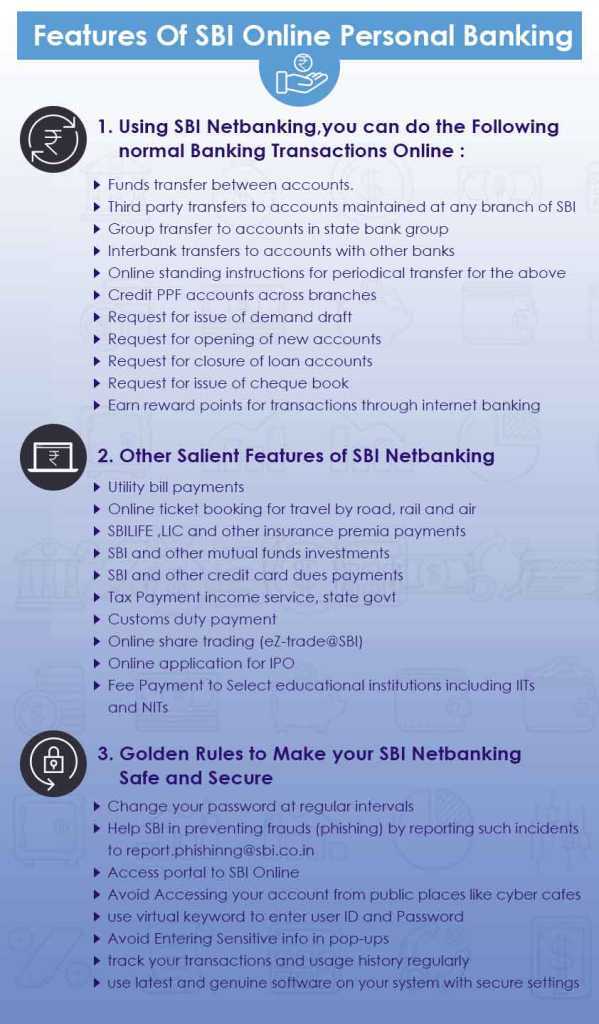

Features of SBI Online Net banking

Features of SBI Credit Cards

mymoneykarma offers the complete range of SBI credit cards online with various benefits and rewards. Each of the SBI credit cards brings their own specific benefits to fulfill all the needs you have. SBI Credit Cards are special as they have different features and cash back offers, depending upon the credit card you choose. The most popular rewards are those of fuel, travel, and shopping

Apply online and get approved for the complete range of SBI Credit Cards instantly on the mymoneykarma website. Before doing so, you should check your credit score at mymoneykarma and find the credit card that you are eligible for. Furthermore, you can check your eligibility in the 'SBI Credit Card Eligibility' section and compare the complete range of SBI Credit cards.

Features of SBI Debit Cards

State bank of India offers various debit cards with the savings bank account that you have with SBI. These debit cards have different features and can be very helpful for you to get benefits through the different features that they offer.

State Bank Classic Debit Card

SBI Classic debit card provides facilities such as withdrawing money, reward programs linked to usage and cashless purchases at merchant outlets across India. The State Bank classic debit card could be used to withdraw cash from any ATM in India and abroad. SBI classic debit cards have a daily cash withdrawal limit of up to a maximum of Rs 40,000/- and customers can purchase at various retail outlets for a maximum of Rs 50,000/- using these cards.

State Bank Silver International Debit Card

SBI Silver International Debit card allows you to withdraw money from your bank account from any corner of the world and shop at over 30 million merchant outlets worldwide with ease. Moreover, it has a bonus scheme for customers wherein it offers double rewards points if a person makes three consecutive purchases on the State Bank Silver International Debit Card in one quarter. This card is useful for people who travel abroad frequently

State Bank Global International Debit Card

The SBI Global International Debit Card allows you to access your money and buy at merchant outlets across the world. On top of that, it also offers comprehensive protection against fraud transactions due to the embedded EMV chip that this card has. The holders of this card can do cashless shopping worldwide and earn unlimited Freedom Rewardz points on all their debit card purchases. The best part is that if you use your card for three continuous purchases in one quarter, you can double the reward points earned.

State Bank Gold International Debit Card

The SBI Gold International Debit Card is great for those who spend a lot as it comes with a high transaction limit of Rs 2,00,000. This allows you to buy all the things you want, without worrying about the limits. On top of this, the customers who have this card also get free life insurance coverage of up to Rs 2 lakhs for the primary account holder. The good news does not end here as this card offers purchase protection insurance for theft or damage of up to Rs 5,000 for things purchased using this card. All these are over and above regular features of accessing your account globally and purchasing at merchant outlets using this card

State Bank Platinum International Debit Card

SBI Platinum International Debit Card helps you purchase goods, book tickets, pay bills, and perform online transactions conveniently. You can use this card internationally to withdraw cash and purchase at shops globally. Moreover, you can triple the reward points earned in a quarter with three successive purchases made using this card. Furthermore, the SBI Platinum debit card holders get free life insurance up to Rs 5 lakhs. On top of this, the SBI platinum debit card offers generous purchase protection insurance of up to Rs 50,000/- for things purchased using this card for 90 days after the purchase.

State Bank Mumbai Metro Combo Card

For people who live in Mumbai and use the Mumbai Metro, SBI launched the State bank Mumbai metro combo card. This cards allows them access the metro as it acts like a metro card in addition to being a debit card. This card is a boon as it allows people to skip the long lines on the metro station. This awesome benefit is on top of all the regular features that help you withdraw money and shop at merchants in India and around the world.

sbiINTOUCH Tap & Go Debit Card

sbiINTOUCH Tap and Go debit card is the first chip-based contactless debit card offered by the State bank of India. Contactless means that this card allows the holders of the card to make payments quickly by just tapping their cards on the payment machine instead of having to insert the card and enter the pin. This is in line with global standards where payments are gradually moving to contactless payments. These contactless payment systems help the people save time and complete transactions faster. This card has all the regular features of debit cards and allows you to withdraw cash as well as purchase at stores.

SBI Online

SBI offers online banking to all its customers. You can log in to your savings account or credit card account using the SBI online facility and see all the transactions you have made on your accounts.

Why Use SBI Online?

By using SBI Online, you can manage your money conveniently.

Features

- Most of the transactions you do in the SBI branch are available on SBI Online banking

- Latest details of your account

- You can access SBI online anytime and from anywhere

- You can skip the queues and spend the time saved with loved ones

Using SBI Online services, you can do the following banking transactions online:

- Funds transfer between own accounts.

- Third party transfers to accounts maintained at any branch of SBI

- Group Transfers to accounts in State Bank Group

- Inter Bank Transfers to accounts with other Banks

- Online standing instructions for periodical transfer for the above

- Credit PPF accounts across branches

- Request for Issue of Demand Draft

- Request for opening of new accounts

- Request for closure of loan accounts

- Request for Issue of cheque book

- Earn reward points for transactions through internet banking

- Utility bill payments

- Online ticket booking for travel by road, rail and air

- SBILIFE, LIC and other insurance premium payments

- SBI and other mutual funds investments

- SBI and other credit card dues payments

- Tax payment � Income, Service, State Govt

- Customs duty payment

- Online share trading (eZ-trade@SBI)

- Online application for IPO

- Fee payment to select educational institutions including IITs and NITs

Happy Banking!

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Important things to know about your State Bank Of India (SBI) Internet Banking

To log in to SBI internet banking for the very first time, you need to use username and password which would be provided to you by SBI branch

OnlineSBI is the net banking portal given by State Bank Of India (SBI), India�s largest lender. Internet banking is the most easy way for banking from any where and at any time. You can login to OnlineSBI, provided that you have an internet-enabled computer that is malware free; you must also have an account with SBI bank and must have enrolled for internet banking services.

Mentioned below are 5 points that we all must know about SBI internet banking:

- A welcome kit containing a user name and password would be provided to you at the branch.

- Log on to www.onlinesbi.com using the username and password. At the time of first login, you'll be prompted to go through a simple procedure to set up your account with SBI online banking. SBI's net banking assistant will help you navigate through this set up process.

- In case you need to sign up for OnlineSBI, you may download the registration forms from the SBI website, fill and submit them at your branch. Your registration formalities are completed after your information is proven and authenticated by your SBI branch.

- It's mandatory to modify the system generated password when you login for the first time. Later, at any point in time, you can change your password but not the login name.

- Passwords may be changed at any time and for any number of times. SBI recommends that customers change their password periodically to secure access on their account records.

FAQs

You need to open a personal banking account with SBI. You can do that by going to your nearest SBI branch.

You can get that in the branch or through sbi online. The internet banking facility can be availed of by visiting SBI online and creating your user name and password for SBI net banking. You will have to verify your bank account and agree to the terms and conditions of sbi internet banking before completing the process.

The SBI online net banking works with nearly all browsers. Safari, Mozilla, Internet Explorer and Google Chrome.

You have to go the the SBI personal banking page and click on the login button. There, you will have to enter you login id and password, and then you can access your account through SBI net banking