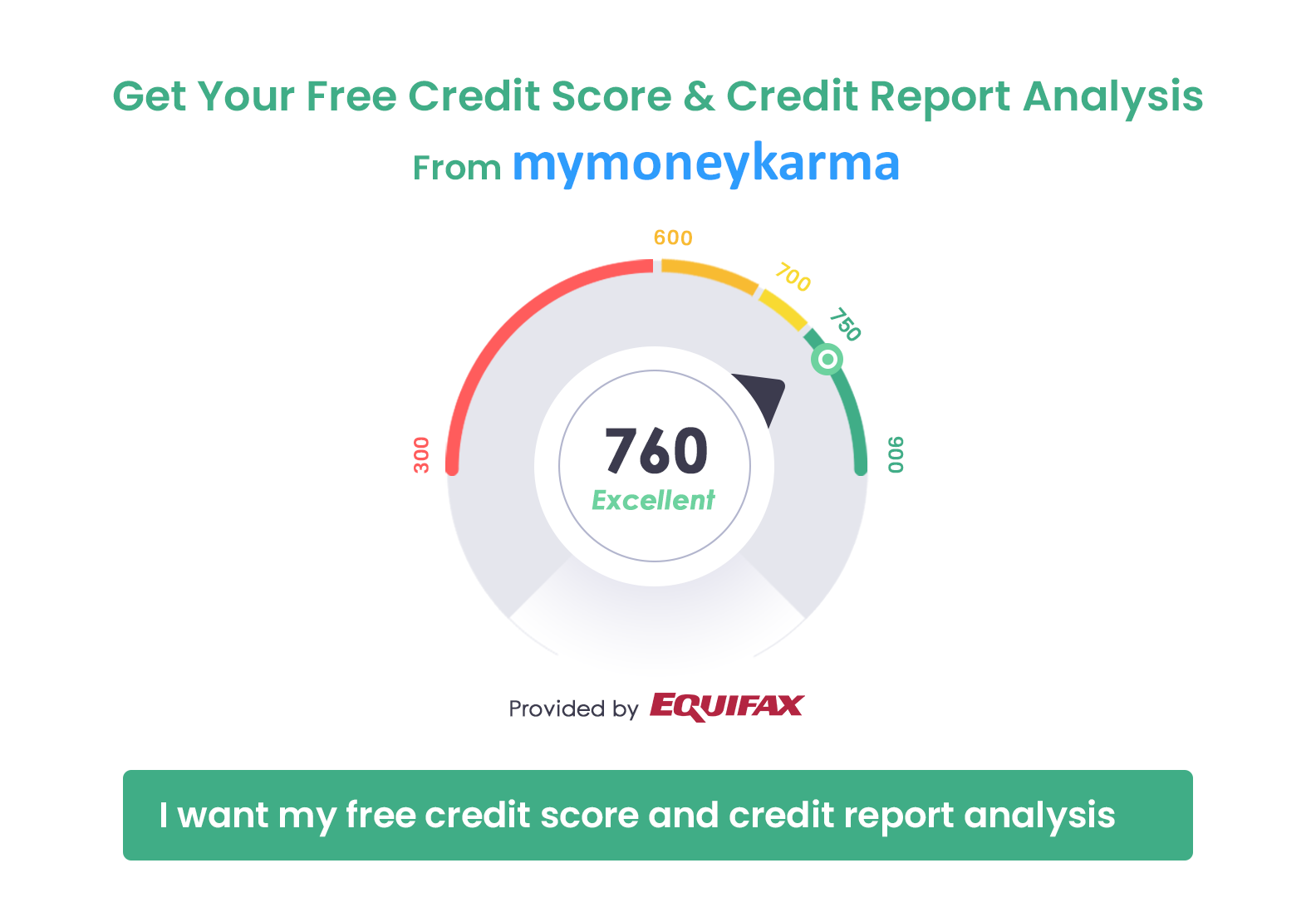

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

ICICI is the largest private sector bank of India. It was established in 1994 by ICICI Limited. The bank has its headquarters in Mumbai, Maharashtra. It offers banking and other financial services to its corporate and retail customers. ICICI Bank has many happy customers due to its expertise in the arena of financial services. Be it loans, investments or simple account opening, ICICI makes its customers its priority and delivers the best services each time.

Products of ICICI Bank

Savings Account

Savings Accounts are the most convenient ways of saving money and earning interest on it. One of the primary reasons why people consider savings account as a great option to park their money is that it is easy to liquidate money kept in the savings account. A complimentary debit card is given to all the savings account holders of the ICICI Bank, which can be used to withdraw money from any ATM in the entire country. Customers can also choose from the various types of savings accounts and apply online for the account that offers them their preferred facilities.

ICICI Bank Personal Loan

With the help of ICICI Bank personal loans, you can easily meet your financial requirements during emergencies. The main feature of these types of loans is the flexibility that it offers. It can be used for wedding expenses, medical needs, paying debts, international vacations, etc. the procedure for applying for personal loans is also straightforward and hassle-free and it requires the applicant to submit the copies of a few documents. Few reasons why you should apply for a personal loan at ICICI are:

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

- Its repayment tenure is highly flexible to 60 months

- The monthly interest charged is on a reducing basis

- There is no need of collateral to apply for personal loan

- The bank provides flexibility in the usage of these funds

- The modes of repayment are quite simple

Car Loan

Now you can own your dream car without any hassle. ICICI Bank offers you secure solutions to car loans. The most attractive feature of car loans provided by ICICI Bank is that you can get a loan of up to 100% of the price of the car. Also, the interest rates applicable to the car loans are highly competitive as well. This loan can be availed by salaried and self-unemployed individuals alike. The car loans can be taken for buying new as well as used cars. Customers who are already the customers of ICICI Bank can get the car loan at even more attractive rate of interest, with the burden of formalities reduced. One of the reasons why many people prefer this car loan is that ICICI bank charges the lowest processing fee of 2% or Rs.6,000, whichever is lower.

ICICI Credit Card

With ICICI Credit Card, never run out of money while shopping! A range of credit cards are offered by ICICI to suit the needs of daily purchases. ICICI credit card comes with excellent benefits for movie-goers, flight booking, dining in high-end restaurants, etc.

Users can also earn while they spend using this card through an exciting rewards program, under which, they can earn 'PAYBACK' points and redeem the same in exchange of purchasing merchandise or gift vouchers. Some popular credit cards by ICICI Bank are-

- ICICI Bank Coral Contactless Card

- ICICI Platinum Chip Card – Visa

- ICICI Bank Jet Airways Sapphiro

- ICICI Ferrari Platinum Credit Card

ICICI Home Loan

ICICI Home Loan is the quickest way to your dream home. The home loans are also available at a desirable rate of interest, and the loans are suitable for both salaried as well as self-employed individuals. The customers can apply for these loans online through the online portal of ICICI Bank. The process of applying for a home loan is hassle-free, and it just requires the applicant to submit a few documents. If the applicant is an existing customer of ICICI, then they would require even less documentation. People who have already taken a home loan could be eligible for a top-up loan that can be used in case of any form of financial emergency or home renovation.

ICICI Bank Gold Loan

ICICI Bank offers Gold Loans to its customers to solve their financial constraints in the time of need. The loan is available against any form of gold, and it can be processed in a matter of minutes. Gold Loans requires the most uncomplicated documentation formalities, and the loan proceeds for as long as the customers want. Also, ICICI offers complete security and transparency of the process. The reasons why gold loans by ICICI are popular are:

- Attractive interest rate

- The documentation process is easy

- The jewelry stays safe

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

ICICI Debit Card

All customers of ICICI, who have a savings account with the bank, get a complimentary debit card that can be used for availing a range of facilities. These cards offer rewards, cash back and other direct discounts to its customers. The ICICI Bank has divided its debit cards into the following categories:

- Gemstone Debit Cards

- Expressions Debit Cards

- Unifare Debit Cards

- Other Debit Cards like Signature, Platinum Debit Cards, etc.

ICICI Bank Fixed Deposit

If you're someone who is shy of the risks involved in the financial market, then one sure-shot way to earn returns without any risk is to open a Fixed Deposit (FD) account with ICICI. ICICI bank offers an exciting range of interest rates to its customers. You can choose a traditional or a reinvestment plan. For the traditional plan, the interest is earned monthly/quarterly, but for a reinvestment plan, the interest is compounded quarterly, and then it is reinvested with the amount as the principal. ICICI also offers loan against a Fixed Deposit account where the customer can loan up to 90% of the amount he/she has saved in FD.

ICICI Bank Loan Against Property

Taking loans against an owned property is one of the popular forms of loans. ICICI offers loans against property at attractive rates of interest to help the applicants meet their financial needs. The best part about the loan granted by ICICI against property is the flexibility that it offers in terms of repayment. These loans against one's property can be taken for a tenure of 15 years. For ICICI Bank, loan against property can be availed for both residential and commercial properties.

ICICI Bank Business Loan

ICICI provides several types of business financing services, such as instant overdraft, working capital loans, and unsecured term loans. Such loans are offered to Small and Medium Enterprises (SMEs) and other businesses that are small in size and want to grow and expand their services. ICICI Bank offers specially customized solutions to the businesses in the form of loans without financials, collateral-free loans, finance for importers and exporters, and loans for school and college-going students