INDUSIND BANK NET BANKING

About IndusInd Bank

IndusInd Bank Limited is a Mumbai-based Indian new era bank, established in 1994. The bank offers top class banking services in retail banking as well as business. IndusInd bank was initiated in April 1994 by then Union Finance Minister, Manmohan Singh. Indusind bank is the first among the new-era private banks in India.

IndusInd Bank has 1500+ branches, and nearly 2500 ATMs as recorded in December 2018. It additionally has an agent office in London and another in Dubai. Mumbai has the maximum number of IndusInd bank offices, followed by New Delhi and Chennai. The bank went on a massive expansion spree and doubled the number of its branches in between 2016 and 2018.

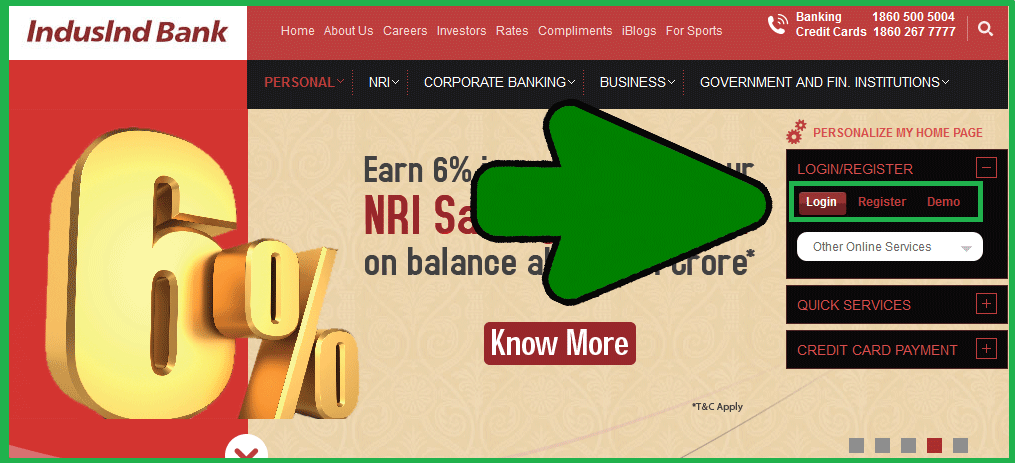

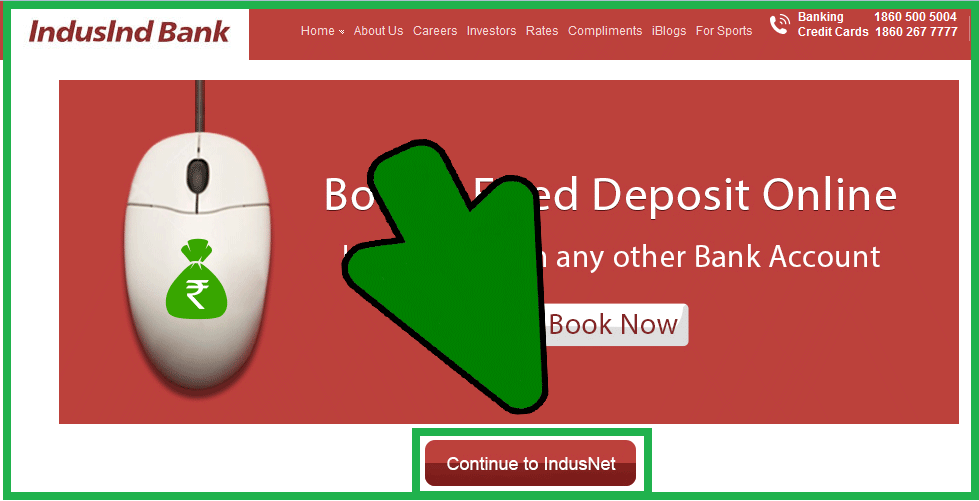

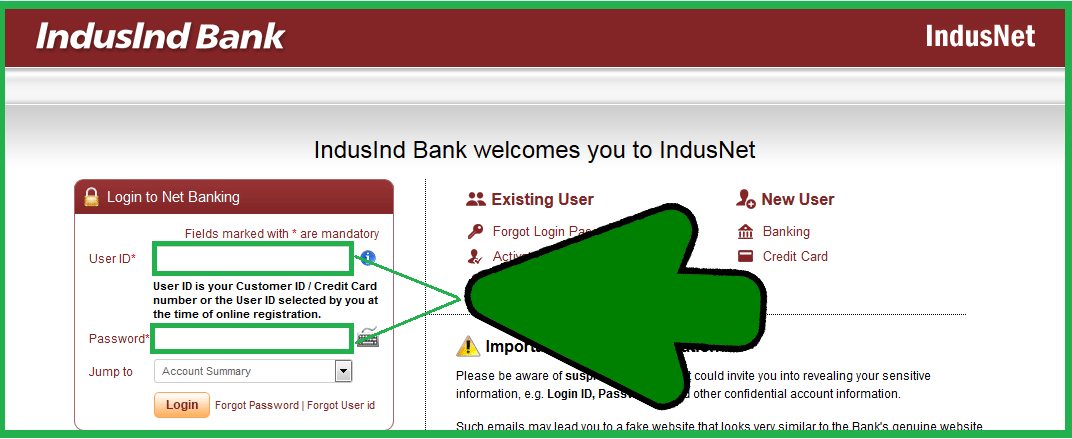

Steps to Login to IndusInd Bank Online Banking

Follow these step-by-step guidelines to login safely to IndusInd bank online banking web portal and start doing your transactions safely.

| http://www.indusind.com/ |

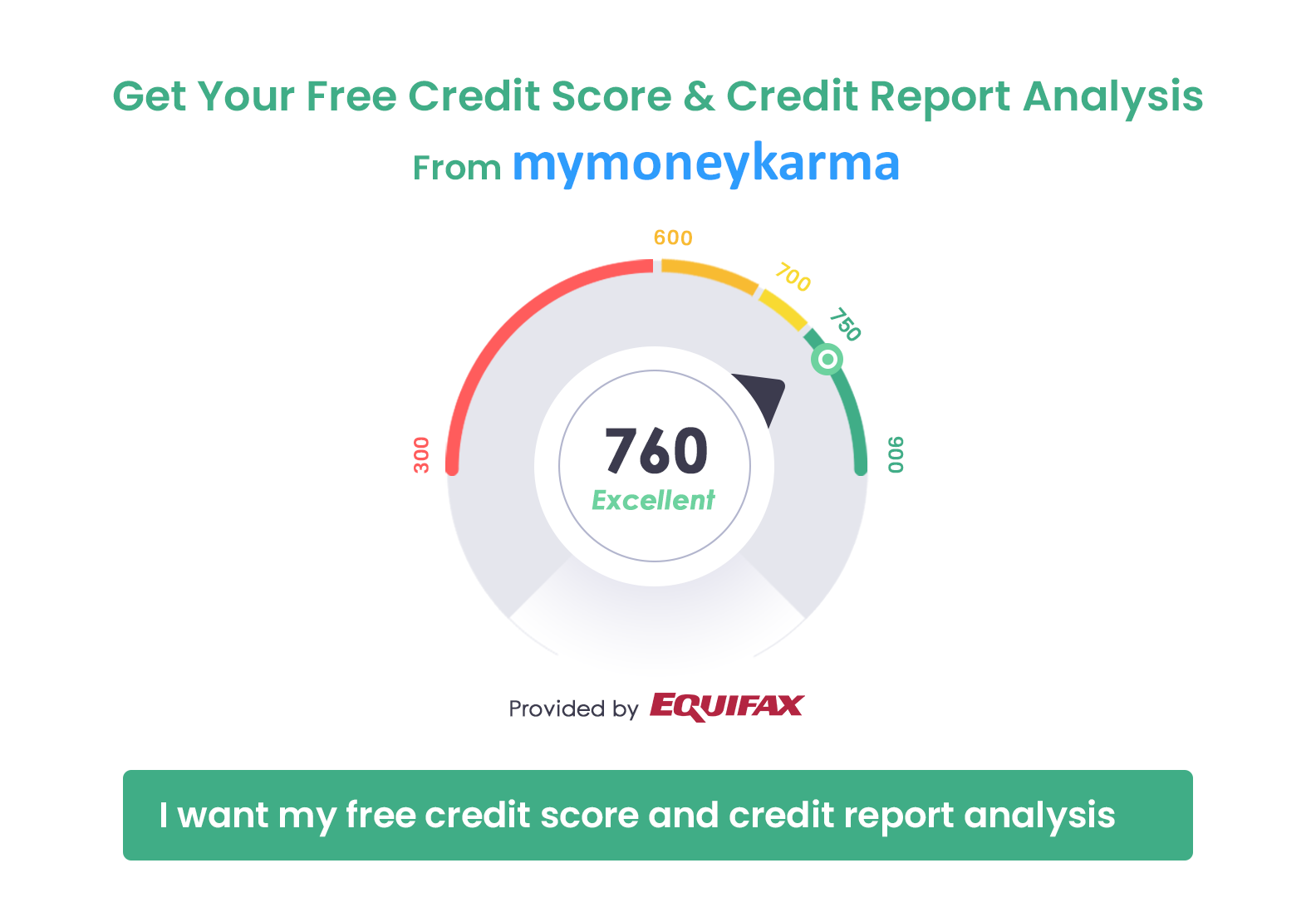

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Refer to the attached screenshot for further clarity.

Please note:

- Verify that the website is secure (i.e., the URL address starts with https)

Continue to access your online account

After selecting the type of user, you need to enter your user name and password to access your online account

Make your life easier!

FREE sign up with mymoneykarma today and view all your Indusind bank transactions in one place.

mymoneykarma helps you to view transactions from Indusind bank and many other banks safely and securely, with one simple login. Create a FREE account with mymoneykarma and manage your money effortlessly.

Happy Banking!