Low Interest Rate Wedding Loan

Do you hear the wedding bells chime? Are you flustered by the excessive planning and expense?

Relax! You're not the only one in this tight spot. The quintessential Indian wedding is indeed a gaudy and expensive affair. Nonetheless, a wedding is a once-in-a-lifetime experience and everyone wants it to be perfect in every possible way. Well, a wedding is a significant milestone and you might want to celebrate your special day with much pomp and opulence, yet the pocket pinch might be a huge hindrance. The venue and decorations, the grand wedding feast, wedding attire and jewelry, hosting the guests, gifts for relatives - all of these certainly don't come cheap. Here's where a wedding loan can come to your rescue.

Click on the button below to proceed to choose a bank, and get to know about the loans available at the cheapest interest rates.

What is a Wedding Loan?

A wedding loan comes under the umbrella of Personal Loans. It is an unsecured loan which does not require any collateral, typically sanctioned based on other criteria such as income level, repayment capacity, employment history and of course credit history. It could be a great way to finance your dream wedding.

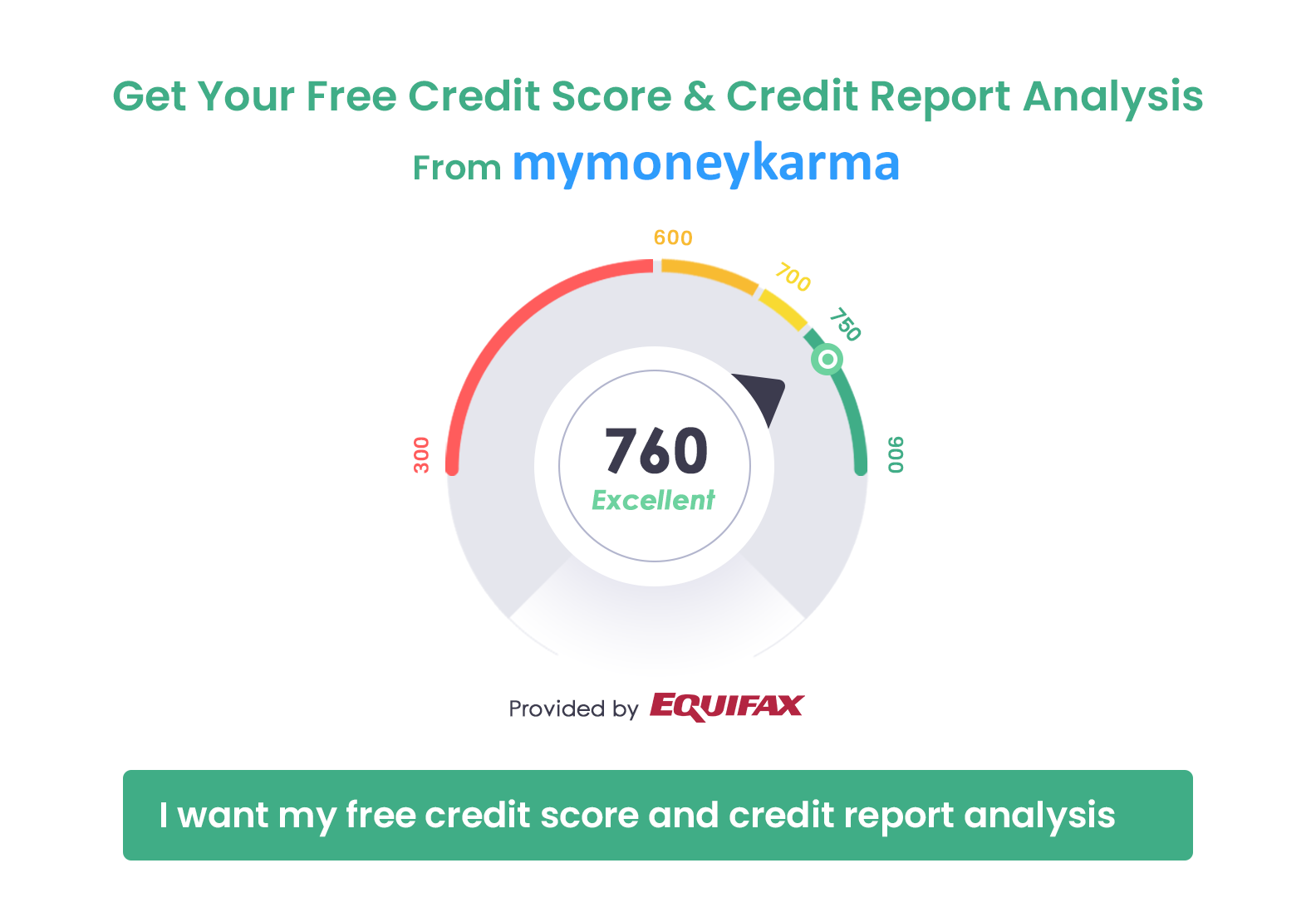

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Where Do I Get a Wedding Loan from?

Most banking and non-banking financial institutions offer wedding loans to help you cope with the tumultuous wedding expenses.

How does a Wedding Loan work?

Just like a Personal Loan, you need to approach a Bank or an NBFC with an application. Most of the financial institutions allow you the convenience of applying for a loan online. They generally approve the loan instantly if you successfully meet their eligibility criteria and provide the required documents. Once the loan is sanctioned, there are no specific restrictions on how to use the loan funds. You need to repay the amount within five years.

What about the Interest Rates for Wedding Loans?

Wedding Loans do not depend upon collaterals. Hence, the interest rates are typically higher than other secured loans. The interest rate for wedding loans is usually between 10 and 19%. It is dependent on several factors like income level, credit score, work experience, profession, age, past loan repayment history. It typically varies from bank to bank. If you have a stellar credit history, you are more likely to get a competitive interest rate on a wedding loan.

Factors to be Considered before Taking a Wedding Loan

- Do the math and decide a realistic number that you can easily repay

- Check out the offerings of several lenders to seek out the best interest rate

- Find out the processing fee and other applicable charges

- Fix a feasible tenure

- Understand the terms and conditions thoroughly and select the one that offers flexibility.

- Ensure that the lender you choose has a high-standard customer service

You could get yourself a wedding loan to fund the entire gala or to get some extra cash if your wedding budget shoots up. A wedding makes a lot of happy memories. However, such beautiful moments often come with a heavy cost. A wedding loan could be a savior; it could give you complete peace of mind about finances for your big day.