Dhanlakshmi Mobile Banking

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Dhanlaxmi Bank has introduced a simple and convenient mobile application to help their customers carry a handful of their banking transactions online, without having to visit the bank. Customers can download the bank’s App from the respective App stores and then activate the app by creating an MPIN. Customers need to submit their debit card details and other credentials when they register for Dhanlaxmi Bank's mobile banking.

DhanSmart is a mobile banking application offered by Dhanlakshmi Bank. It provides a fantastic experience to its customers with enhanced banking services and features. The app permits customers to check the details of their accounts and perform transactions. The DhanSmart app is currently available for Android/ iOS and Windows phones.

How to Activate DhanSmart Mobile Banking App on Mobile?

After installing the application from the google play store or iOS app store, these are the steps that you may follow to activate the Dhanlakshmi Bank mobile banking app:

-

If you are a first time user - Open the app and click on the 'Login' icon. You can create an MPIN/TPIN by clicking on 'Create MPIN' button present on the login screen of the app. For creating MPIN/TPIN, please keep your debit card and the registered mobile number handy.

-

If you are an existing customer and don't remember the password - Click on "Forget MPIN' icon and generate it using your debit card credentials. You will receive an OTP on your registered phone number. Enter the OTP details to validate the process and then create a new MPIN/TPIN.

Note: MPIN is a six digit password or PIN (Personal Identification Number) that you require for login; TPIN is a six digit password or PIN (Personal Identification Number) required for transaction purposes.

How to Register for DhanSmart Mobile Banking?

The existing customers can register for Dhanlakshmi bank mobile banking by downloading the registration form or mobile banking request form from the bank's website and submitting it in a nearby branch. The mobile banking facility of Dhanlakshmi bank is presently available only to those retail banking customers who have either savings or current accounts (individual) with ATM/Debit Card.

Dhanlakshmi bank mobile banking facility is not available to the following customers:

-

Non-ATM/Debit Card holders (Individual customers)

-

Minor Account Holders

-

JAO (Joint And Others) and JAF (Joint And First) type joint account holders.

Features of Dhanlaxmi Bank Mobile Banking

Dhanlaxmi Bank's mobile banking has the following features:

- Checking the account balance instantly

- Viewing the last ten transactions

- Accessing Dhanlaxmi Bank credit card details

- Transferring funds through NEFT, RTGS and IMPS

- Recharging mobile phones or DTH connection

- Requesting for a chequebook

Dhanlaxmi Bank fund transfer options

Customers of Dhanlaxmi Bank can easily transfer funds through NEFT, RTGS, and IMPS.

NEFT - National Electronic Fund Transfer system or NEFT is a mode of electronic fund transfer that works on the basis of DNS or Deferred Net Settlement at specific times of the day. In NEFT, the transactions are carried out between banks via payment instructions. There is no set limit for NEFT transactions done at the bank. However, there is a limit of Rs.1 lakh per day via Mobile Banking.

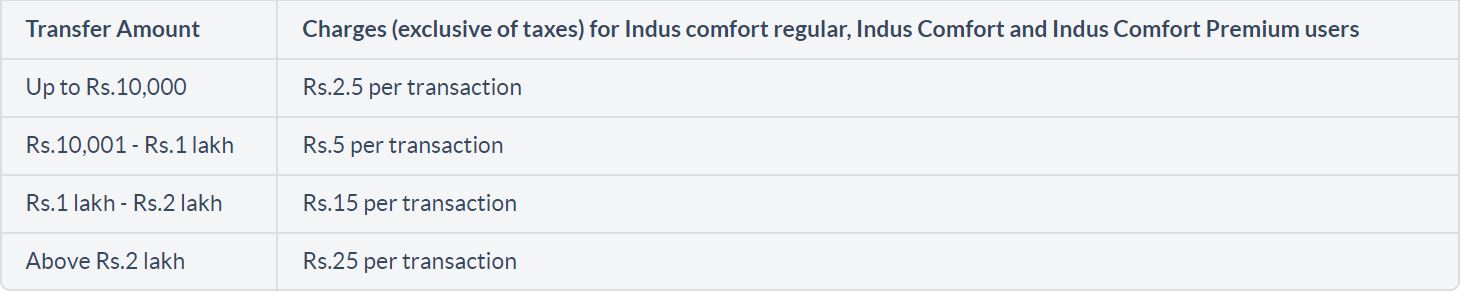

IMPS - Immediate Payment Service, as the name suggests, is an instant way of electronic fund transfer. It is mainly used for inter-bank transactions. Dhanlaxmi Bank provides the IMPS facility to all its customers who have registered for using online services. It enables you to send as well as receive money at odd hours and even on Bank Holidays. The transferred money is directly credited to the beneficiary account. You must add a beneficiary to make IMPS transfers. This service is available 24x7.

RTGS – Real Time Gross Settlement or RTGS transfer funds at the real-time, based on the received transfer instructions. The funds are individually settled as per instruction. RTGS happens to be the fastest way of interbank money transfer in our country. HSBC charges Rs.25 from their customers for transfer of Rs. 2 lakh to Rs. 5 lakh, and Rs. 50 for any amount above it through RTGS.

Benefits of Dhanlaxmi Mobile Banking

- It saves a lot of time as customers need not visit the bank for minor chores.

- It gives constant account updates for customers to keep track of their account at all times.

- It sends transaction alerts to help the customers identify and report any unauthorized transaction or fraudulent activities.

- The mobile banking app has a dedicated platform for paying bills.

- The mobile banking app also lets customers transfer funds without hassles in very less time.

- It is free of cost.

Dhanlaxmi Bank Mobile Banking Security Measures

- A strict security system protects the mobile banking browser.

- The transactions are made through 128-bit SSL encrypted medium. It is the highest level of security for Internet-based banking apps.

- Customers use a unique customer ID number and a strong password to protect the account.

- Customers need to use OTP to authorize every transaction.

Dhanlaxmi Mobile Banking: Do’s

- Set a different and unique password for mobile banking.

- Install anti-virus on your mobile handset.

- Download and regularly run security updates on your mobile browser.

- Delete the browsing history on a regular basis.

- Delete spam messages regularly

Dhanlaxmi Mobile Banking: Dont’s

- Avoid opening attachments or links received from unknown sources.

- Never share your login details with anyone.

- Don't use public networks for banking transactions.

- Never write your password anywhere.

- Don't click on the 'back' button on your phone if you want to go back to the previous page. Instead, use the 'back' button on the navigation tab of the browser.

®

®