IndusInd Bank Mobile Banking

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

IndusInd Bank knows that time is very crucial. With an objective to help their customers save time, the IndusInd Bank has introduced the mobile banking service with great features. It lets you pay your restaurant bills, recharge your phone, apart from basic banking needs like funds transfer, checking account balance and statements. IndusInd Bank's mobile banking services work on Apple and Android platforms.

Register for Mobile Banking

Gone are the days where you stand in long queues in banks to transfer your funds, check your balance, apply for a debit/credit card, etc. You can do all your bank related stuff from your home if you have Mobile Banking. Registering for Mobile Banking in IndusInd Bank is quite simple. You can opt for any of the following methods to register for IndusInd Mobile Banking:

-

Reach out to the nearest IndusInd bank and register by filling up the Mobile Banking application form.

-

Register through any nearby IndusInd Bank ATM.

-

Contact the IndusInd customer care executive and place the request.

-

Download the IndusMobile App from google play store or iOS app store and register online using Netbanking credentials/ Credit or Debit cards.

Activate Mobile Banking

After registering in the IndusMobile App, in order to use the banking services, you must activate IndusInd Mobile Banking App by setting the authorization method. For your convenience, IndusInd bank has given you options to select the authorization method of your choice:

-

MPIN: Mobile banking Personal Identification Number (MPIN) is a 4/6 digit secret code similar to an ATM PIN.

-

SWYPE: SWYPE is a new feature introduced by IndusInd that is similar to the pattern used on Android phones.

-

BIOMETRIC: If your mobile has a biometric feature, the same can be used to authorize your transactions.

Features of IndusInd Bank Mobile Banking

Indus Mobile SMS: You can do almost all banking transactions using IndusInd Bank’s SMS Banking service. You need to link your phone number with your bank account to avail of these services. You can keep an eye on your bank account through IndusInd's SMS banking service. There are keywords like 'Bal,' 'Mini' and 'Recharge' that has to be sent as SMS to 9212299955 to get all account information, transaction history or even recharge a prepaid phone.

Missed Call Banking: You can conveniently check your account balance by giving a missed call to 18002741000 from your registered phone number. You can apply for a loan by giving a missed call to 18005323344 or to 18008336677 for any other products offered by the IndusInd Bank.

Indus Mobile USSD: If you dial *99*69# from your registered phone number, you can get your account details through the Indus Mobile USSD.

Indus-mobile app: You can download the Indus-mobile app and transfer money, check your account balance, recharge your mobile or your DTH account.

Indus Alerts: You can get instant access to your credit card information through Indus alerts. This option lets you check the minimum due amount, your available credit limit as well as your last bill statement.

IndusInd Bank fund transfer options

Customers of IndusInd Bank can easily transfer funds through NEFT, RTGS, and IMPS.

NEFT - National Electronic Fund Transfer system or NEFT is a mode of electronic fund transfer that works on the basis of DNS or Deferred Net Settlement at specific times of the day. In NEFT, the transactions are carried out between banks via payment instructions. There is no set limit for NEFT transactions done at the bank. However, there is a limit of Rs.1 lakh per day via Mobile Banking.

IMPS - Immediate Payment Service, as the name suggests, is an instant way of electronic fund transfer. It is mainly used for inter-bank transactions. IndusInd Bank provides the IMPS facility to all its customers who have registered for using online services. It enables you to send as well as receive money at odd hours and even on Bank Holidays. The transferred money is directly credited to the beneficiary account. You must add a beneficiary to make IMPS transfers. This service is available 24x7.

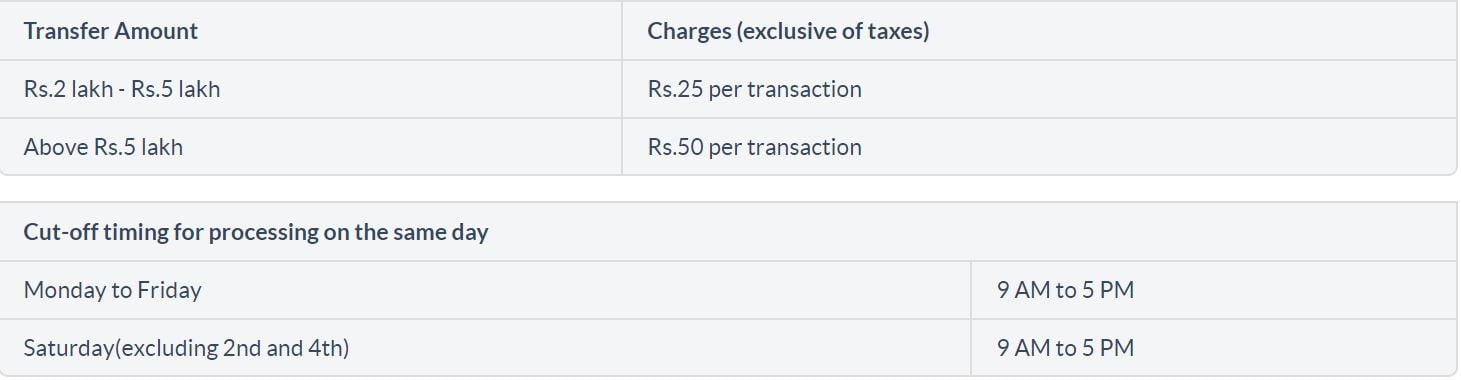

RTGS - Real Time Gross Settlement or RTGS transfer funds at the real-time, based on the received transfer instructions. The funds are individually settled as per instruction. RTGS happens to be the fastest way of interbank money transfer in our country. IndusInd Bank charges Rs.25 from their customers for transfer of Rs. 2 lakh to Rs. 5 lakh, and Rs. 50 for any amount above it through RTGS.

Benefits of IndusInd Mobile Banking

- It saves a lot of time.

- It gives all the information in different languages.

- It lets you do most banking transactions on the go.

- It aids you in checking your account balance, requesting for a chequebook, inquiring on your deposit accounts and more.

- It facilitates funds transfer instantly.

- It locates the nearest bank branch.

- The facilities are free of cost.

IndusInd Bank Mobile Banking Security Measures

- Nobody can access your account as you can log in to your it only with your login credentials.

- The 128-bit Secure Socket Layer technology ensures that all your account data and information is encrypted and protected.

- Five incorrect attempts at logging in will lock down your account automatically.

- NULL of your confidential data is saved on the SIM card or the device.

IndusInd Mobile Banking: Do’s

- Secure your mobile phone with a unique password, which is not to be shared with anyone.

- Choose a strong password containing a mix of alphanumeric and special characters.

- Change your password frequently to ensure safety.

- Report the incident to the bank and the nearest police station without delay in case of theft or loss of your phone.

- Be attentive towards attention all communication you receive from the bank.

- Always log out after completing a transaction.

IndusInd Mobile Banking: Dont’s

- Never share your login ID and password with anyone.

- Never write down your password anywhere.

- Never add beneficiaries whom you do not know.

- Avoid changing your contact details without informing the bank.

- Stay safe from hoax calls, SMS or emails.

- Never use shared networks for banking transactions.

®

®