efiling Income Tax

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

The Income Tax Act states that any individual whose salary comes in the taxable income must file the income tax returns for every financial year. The procedure of filing income tax online is known as e filing. Efiling income tax is convenient for people and it saves a lot of time for everyone. An individual must register in the online portal of the Income Tax Department to avail the benefits of e filing.

Benefits of ITR filing

-

Efiling portal can be accessed by any individual 24x7. This is one of the major reasons why filing your income tax returns through the online portal is more convenient than visiting the Income Tax office to file your income tax.

-

The time taken for processing of the payment is very less

-

Manual filing poses the risk of identity and data theft which can be avoided easily by using the online portal to file income tax

-

No possibility of human errors

-

The taxpayer receives an acknowledgement slip after making the payment through online portal. This slip can be used as a proof that the tax has been paid

-

The details of e filing is registered in the profile of an individual with the income tax department. Anyone can get access to the records of ITR which they have filed in the past by using their username and password.

-

The detailed instructions and guidelines related to efiling income tax is available in the e filing website.

-

E-Banking is one of the essential features of the e-filing website. Electronic banking allows the users to make payments towards the Income Tax Department through the netbanking websites of their respective banks.

Is it compulsory to file Income Tax through the e-filing website?

E-filing of Income Tax Returns is compulsory for everyone except for taxpayers over eighty years old and the members of HUF whose salary is less than five lakhs and who do not claim any refund in the tax that they pay.

Since it is mandatory for all the assessees to file their Income Tax Returns through the e-filing online portal, it is essential to know that the forms are available in the e-filing portal and the assessee needs to make sure that they fill up the correct form according to the Income Tax Slab that they come under.

ITR forms: Which one to file?

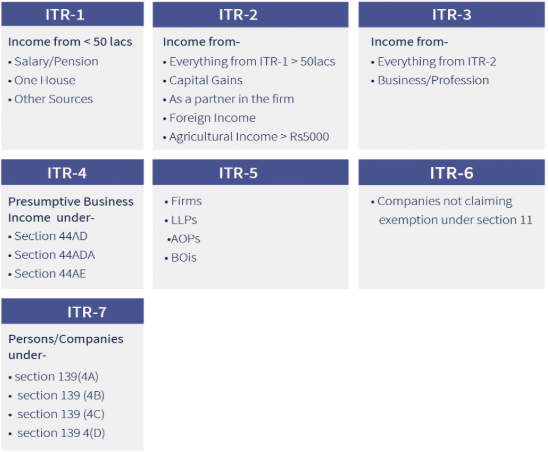

ITR form or income tax return form is used by an individual to file income tax with the income tax department. There are upto nine types of ITR forms which can be used by an assessee to file for income tax return. The ITR form is filed with the internal revenue service or the state tax board, reporting your income, profits and losses.

Why is it mandatory for taxpayers to file their Income Tax Returns?

Filing returns is a yearly exercise that is as a social and moral duty of every responsible citizen of a country. It helps the government to estimate the amount and nature of expenditure of the citizens and it provides a channel for the assessee to claim a refund on the income tax filed.

It is crucial for taxpayers to file their income tax since it serves as a proof of a taxpayer income which has been approved by the

Income Tax Department.

There are many advantages of being tax compliant. Some benefits of being tax compliant are mentioned below:

-

Provides easy to good accommodation

-

Provides easy access to good vehicle

-

Provides easy access to good education

-

It prevents you from the hassles of not filing ITR

Filing income tax returns is very essential, particularly if the taxpayer is planning apply for any form of credit. It is critical for the taxpayer to provide his/her details of income tax returns along with receipts while applying for a home/car loan. There are high chances of a bank refusing the loan application of an applicant if the applicant has not filed income tax returns over the last three years.

Types of ITR forms

-

ITR-1

-

ITR-2

-

ITR-2A

-

ITR-3

-

ITR-4

-

ITR-4S

-

ITR-5

-

ITR-6

-

ITR-7

As per Central Board of Direct Taxes, the only types of ITR forms that are concerned with the filing of taxes by individuals are ITR-1, ITR-2, ITR-2A, ITR-3, ITR-4 and ITR 4S

The types of ITR forms that are concerned with companies and businesses are ITR-5, ITR-6 and ITR-7.

How to file Income Tax Returns?

The taxpayer must complete the registration process in order to access the e-filing website-

-

Click on ‘Register Yourself’

-

Select the User Type

-

Click on ‘continue’ button

-

Enter the basic details like name, PAN details, date of birth/date of incorporation, email ID and mobile number.

-

Your details will be verified electronically and the registration form will open

-

Provide all the personal details such as correspondence address, residential address etc

-

Enter the Captcha

-

Click on the ‘Submit’ button.

-

After the registration is complete, you will get a Registration Successful notification on the website

-

An OTP will be sent to your mobile number and an activation link is sent to your email

-

Click on the activation link or use the OTP sent to your registered mobile number, to complete your e-filing registration process.

Now you’re ready to access your e-filing website.

For e-filing income tax online, here are a few steps that you must follow-

-

Login to e-filing website using your user ID, password, date of birth/date of incorporation and captcha

-

Go to e-file and click on ‘Prepare and submit ITR online’

-

Select the ITR 1/ITR 4S form and the assessment year. Note that only ITR 1 and ITR 4S can be e-filed online

-

Fill in the details and click on ‘Submit’ button

-

Upload Digital Signature certificate, if applicable.Please ensure that your DSC is linked with your e-filing.

-

Click on ‘Submit’ button

-

On successful submission, if the ITR is submitted along with the DSC, ITR-V will be displayed. Click on the link to download ITR-V. The ITR V form is also sent to your registered e-mail ID.

OR,

If the ITR isn’t submitted along with DSC, then it should be printed, signed and sent to CPC within 120 days from the date of e-filing. The return will be processed only upon the receipt of signed ITR-V.

You can follow these steps to e-file income tax offline-

-

Download the relevant form from the ITR Preparation Utilities section of the e filing website

-

Prepare your tax return using the downloaded software

-

Login to the e-filing portal by user ID and password

-

Enter the Captcha

-

Your profile will open on the screen.

-

Go to e-file and click on ‘Upload Return ITR-V’

-

Select the appropriate ITR, assessment year and the XML file which was saved previously in step 2

-

Upload the Digital Signature certificate, if applicable. If you’re uploading DSC, then you should ensure that your DSC is registered with e-filing website)

-

You can generate your DSC on the same page under the DSC Utility Section

If the ITR is uploaded along with the digital security certificate (DSC) by a company then the ITR-V form will be displayed on the webpage. Follow the link to download the ITR-V form. The ITR-V form is also sent to your registered e-mail ID. If you haven’t uploaded your digital signature certificate along with your ITR V form, then you need to download the form, take a printout and submit it to the CPC within 120 days.

If you haven’t uploaded your digital signature certificate along with your ITR V form, then you need to download the form, take a printout and submit it to the CPC within 120 days.

Documents required for e-filing of income tax

The documents required depend on the type of Income that they are reporting to the income tax department

For salaried employees, the documents required are-

-

Form 16

-

Copy of Pan Card

-

Bank Statement

For reporting capital gains, required documents are-

-

Stock trading statement along with purchase details if there are capital gains after selling the shares

-

When a house/property is sold, then the details like sale price, purchase price, details of registration and capital gains details are required

-

Details of mutual funds statement, sale and purchase of equity funds, debt funds, Equity linked saving scheme and SIPs.

For reporting house property income, the documents required are-

-

Address of the property

-

Details of the co-owners

-

If the property has been rented to someone, then you must provide the details of tenant and the rental income accrued from the property

-

Certificate stating that home loan has been taken by the property owner

Under section 80C, the maximum amount that can be claimed from your income tax return is 1.5 lacs. Many tax exemptions and deductions can be directly claimed while filing your Income tax returns, such as-

-

Your contribution to the Provident Fund

-

Your children’s school tuition fees

-

Life insurance premium payment

-

Principal amount paid on home loan

-

Stamp duty and registration charges

-

Equity linked savings schemes (ELSS) / mutual fund investments

You need to keep the documents and bills linked with the payments made in order to claim the exemption under section 80C

What is the use of correspondence of Form 16 and Form 26AS

Form 16 is filled by the employer or the person who collected the taxes in the form of TDS. Form 26AS contains the details of the taxes that have been deducted from the assessee's income.

During the filing of ITR, the assessee must check the details provided by them in the form 26AS. And, it is also essential that the details provided by the assessee in form 16 and form 26AS match completely. If there is any form of discrepancy in the information provided, then the assessee must inform the Income Tax Department by writing a letter addressed to the head, along with the documents that would act as a proof to the claimed discrepancy.

What can be done if an Individual forgets their login ID/password to their e-filing profile?

If an individual forgets their login ID or password, then it is essential to know that the password is not retrievable. If an individual forgets the password to their e-filing profile, they may not be able to retrieve it.

What are the consequences of not filing the Income Tax Returns (ITR) on time?

The Income Tax Returns (ITR) must be filed before the end of July of that month of the respective Assessment Year. For instance, if you're filing Income Tax Returns for the Assessment Year 2017-18, then the due date will be 31st August 2018. However, it is you must keep in mind that failing to file income tax returns before due date could attract penalty and interest. Penalty and interest are levied on the taxpayer based on the circumstances. Either penalty or interest or both is collected from the taxpayer who fails to file their income tax returns on time. Below mentioned are the troubles that could be faced by a taxpayer if they fail to file their income tax returns on time.

Penalty: Under Section 271F of the Income Tax Act

A penalty of Rs.5,000 could be levied upon a taxpayer by assessing officer if he/she fails to file income tax returns before the due date for the corresponding assessment year. Non-filing of ITR could also attract the same penalty amount.

Note: With effect from 1 April 2018, the penalty provisions concerning the filing of income tax returns has been eliminated for assessment years commencing on or after the date mentioned above. Instead of Section 271F of the Income Tax Act, the new Section 234F has been formulated under the Act. According to the provisions of Section 234F, a fee will be levied if someone delays in filing the Income Tax Returns (ITR). This fee will be applicable from the Assessment Year 2018-19.

Interest under Section 234A

As per the provisions of Section 234A, of Income Tax Act, a penal interest of 1% each month or a portion will be levied on the tax amount if there's a delay or non-filing of Income Tax Returns. The interest is compounded from the due date of payment till the date on which the income tax was paid.

Losses Won't Be Carried Forward

In case of delay or non-filing of Income Tax Returns (ITR), the taxpayer is not allowed to carry forward their loss. However, according to the provisions of Section 139(1) of Income Tax Act, the losses which arise under the head "Income from House Property' will be allowed to be carried forward despite the failure to file Income Tax Returns on time.

Claiming Refund of Taxes

A taxpayer should file his/her Income Tax Returns (ITR) for claiming the refund on Tax Deducted at Source (TDS). There could be situations where the original payable tax is lesser than the tax that has already been deducted through TDS. In such a scenario, the taxpayer can claim refund by filing for Income Tax Refund.

Assessment under Section 144 of the Income Tax Act

Assessment under Section 144 is popularly known as the Best Judgement Assessment. This responsibility comes on the assessing officer in the following cases:

When the taxpayer is in non-compliance to the notice terms issued under Section 142(1) of the Income Tax Act.

When a taxpayer within the due date doesn't file the returns according to the prescription of Section 139(1) of the Income Tax Act, an overdue return according to Section 139(4), or a revised return as per Section 139(5) can be filed by the assessee.

The assessing officer is responsible for taking the necessary step depending on the information and materials that he/she collects linked with the situation.

The penalty levied for cases where the income is concealed

If a taxpayer conceals his/her income from the Income Tax Department, a penalty is levied on the taxpayer as per the Income Tax Act. According to the Act, until the assessment year 2016-17, a penalty was levied as per the provisions of Section 271 (1) (c) of the Income Tax Act. The penalty under Section 271 (1) (c) is levied on the taxpayer in case of non-filing of returns for the taxable income, non-compliance with notices and for the concealing the taxable income from Income Tax Department.

Note: A distinct Section 270A was implemented on 1 April 2017 by the Finance Act of 2016. This section introduced a penalty for underreporting or misreporting the taxable income.

How to Reset the Password on Income Tax E-Filing Website?

Forgetting the password is a common affair. Usually, we forget the passwords to the media we don't use frequently. Since filing ITR isn't an everyday task, forgetting the password to your income tax return (ITR) filing account is more common than you think.

Since e-filing is mandatory and all the taxpayers are required to log in to their respective accounts to access their efiling Income Tax Return accounts, what can you do to retrieve the password to log in to your account?

You can use any of the four methods to retrieve your efiling Income Tax account:

-

Answering the secret question which was set by you while setting up the account.

-

Uploading your Digital Signature Certificate (DSC) to the portal.

-

Generating an OTP (One Time Password) on your Registered Mobile Number.

-

Generating an OTP on your Aadhaar Registered Number.

On the official e-filing website, you should click on the "Forgot Password' link. This will redirect you to a new page where you'll be required to enter your user ID (PAN) and the captcha code. After this, click on the "Continue' tab and follow the instructions listed on the screen. You can follow any of the four methods described above to reset your password.

Frequently Asked Questions on efiling Income Tax

What is the tentative date of filing Income Tax for every Assessment Year?

The tentative date for efiling income tax is 31st July of every year. However, it is extended till August almost every year.

How can I reset my password on efiling Income Tax website?

You can reset your password by clicking on the link which says Forgot Password, then following the necessary steps.

You can use any of the four methods to retrieve your efiling Income Tax account:

-

Answering the secret question which was set by you while setting up the account.

-

Uploading your Digital Signature Certificate (DSC) to the portal.

-

Generating an OTP (One Time Password) on your Registered Mobile Number.

-

Generating an OTP on your Aadhaar Registered Number.

What are the consequences of not filing income tax?

You'll be liable for penalty or imprisonment depending on the degree of negligence shown. Either penalty or interest or both is collected from the taxpayer who fails to file their income tax returns on time. Below mentioned are the troubles that could be faced by a taxpayer if they fail to file their income tax returns on time.

®

®