Bank of Maharashtra Savings Account

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

A public sector bank with nearly 2000 branches in the country, Bank of Maharashtra was set up in Pune in the year 1935. It offers an array of products like private banking, investment banking, commercial banking, mortgage, retail banking, and credit cards alongside other products. Bank of Maharashtra offers the co-branded BoM SBI credit card to its customers.

Types of Bank of Maharashtra Savings Account

Mahabank Savings Bank Scheme: This savings account can be opened by Indian residents individually or jointly. A minor can also open this account jointly with a parent or a legal guardian. Apart from the general documents required to open a bank account, an individual can also open an account through an existing account holder with the bank who serves as an "introducer". The introducer needs to comply with the complete KYC procedure and must also have an operative bank account for more than six months with the bank.

Mahabank Yuva Yojana: This account is meant for children aged between the age of 10 and 18 years. The object of this account is to impart and inculcate the habit of saving money in children.

Mahabank Lok Bachat Yojana: This account is particularly designed for people who have a very low income and those hailing from the BPL (below poverty line) category. Any minor from the BPL category can open this type of account as well.

Mahabank Royal Savings Account: This is a standard savings account with a zero balance facility. Resident Indians can open this type of account individually or jointly. Similarly registered Institutions, Associations, Clubs, Societies, Trusts, etc. can also open this account.

Mahabank Purple Savings Account: This savings account can be opened by resident Indians, either individually or as a joint account. The account offers zero balance facility and also assures special personal assistance to customers by a relationship manager.

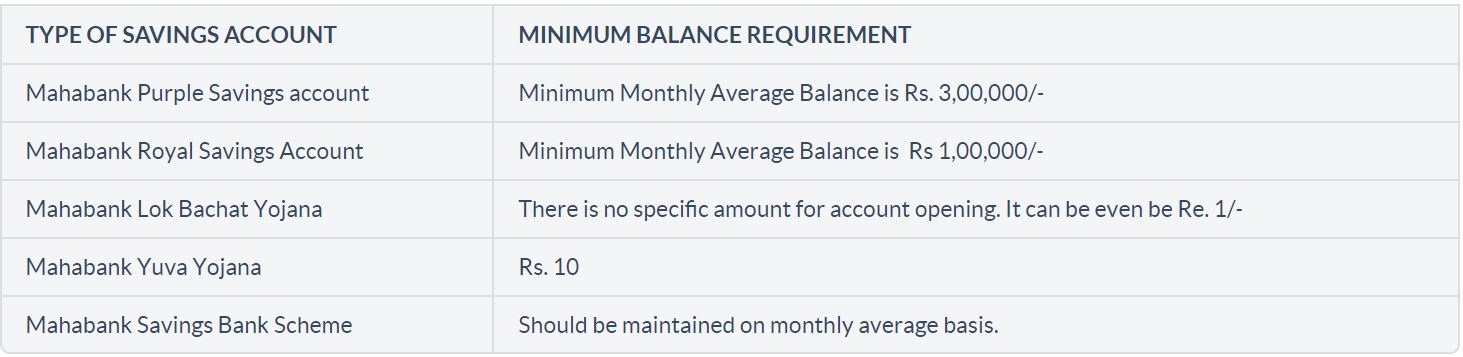

Maharashtra Bank Savings Account Minimum Balance Requirements

Documentation

These documents are required to open a Savings Account with the Bank of Maharashtra:

- Two recent passport size photographs.

- Proof of Age – birth certificate, mark sheet of Secondary level board examination or any Valid ID proof containing the date of birth.

- Valid Address proof – passport, ration card, Aadhaar card, PAN card, telephone bill, electricity bill, etc.

- Valid ID proof issued by the Indian Government – Passport, PAN Card, Aadhaar Card, Voter’s ID Card, Valid Driving License, etc.

- Proof of income – bank account statements, salary slips,

- Income tax declaration or form 16.

- Hindu Undivided Family accounts require a valid address proof, identity proof, PAN Card, Form 60 and a declaration from the 'Karta'.

For joint accounts, all these documents from both the applicants will be required, along with a proof of the relationship between both the account holders.

FAQs

- What are the different types of Savings Bank accounts in Bank of Maharashtra?

Ans: The following are the different savings account offered by Bank of Maharashtra:

- Mahabank Savings Bank Scheme

- Mahabank Lok Bachat Yojana

- Mahabank Royal Savings Account

- Mahabank Yuva Yojana

- Mahabank Purple Savings Account

- What is the minimum balance requirement for opening the Mahabank Lok Bachat Yojana account?

Ans. There is no minimum balance requirement for this account. It can be opened at Re. 1.

- What is the rate of interest of Mahabank Savings Bank Scheme?

Ans. It is 4% per annum.

- As a Hindu Undivided Family, what are the documents required to open a savings account?

Ans. HUFs must submit valid address and identity proof along with PAN Card or Form 60 or Declaration from the 'Karta' of the family.

®

®