EPF Forms

There are various forms which are required to be filled for claiming the benefit of EPF:

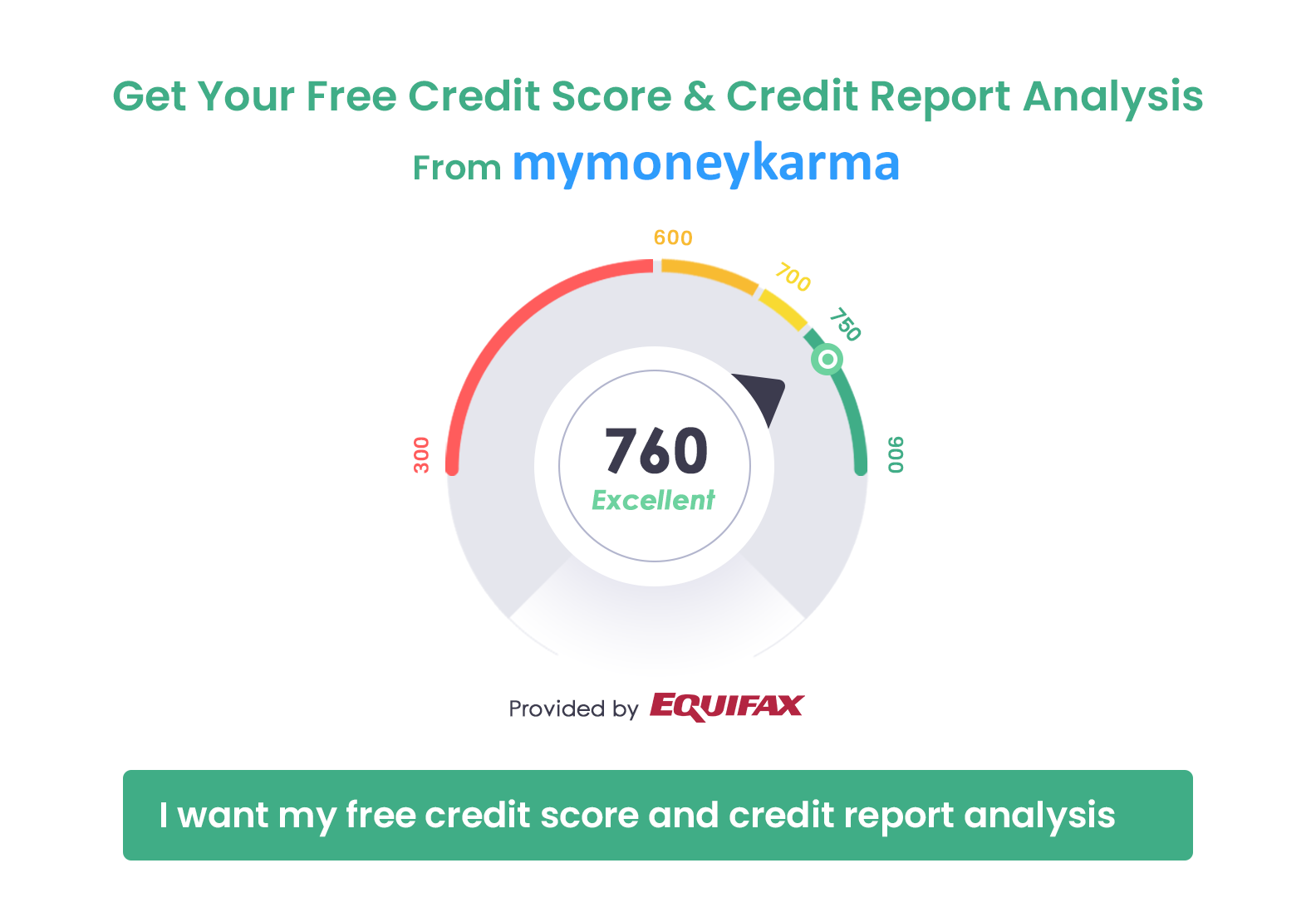

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

EPF Form 14:

Form 14 is used as an application form for financing the life insurance policy. This facility is available to those who have completed two years tenure in the service.

EPF Form 19:

Form 19 is for the final settlement of PF and should be submitted by the employee for withdrawing Provident Fund dues on leaving service, retirement or termination if the person is not looking to join another establishment. If the employee wants to transfer an account from one organisation to another, then Form 13 will be the right option to choose.

EPF Form 31:

PF accounts are restricted for premature withdrawals due to long term saving process but there are certain conditions in which employees can withdraw the amount such as:

For buying or building a house for residential purpose or for buying a plot: After completion of five years of the service, an employee can submit the form 31 to the employer with a signed declaration for buying a property 36 times or 24 times of his/her wages, which comes under his/her name or held jointly in the name of his/her spouse.

For renovating or repairing house which includes addition or removal of parts of house too: Employee need to complete five years in service for making any additions or alterations in the house and ten years of service for repair of the house.

For repaying home loan.

For funding self-marriage or of children or siblings which is applicable only after seven years of service completion.In this employee need to submit form along with invitation card of marriage to the employer but only 50% of the interest and share in EPF account can be withdrawn.

For Financing Education: Here the employee can claim only 50% of his /her share and interest in EPF account for the withdrawal, after completion of seven years of service. Along with form 31, educational institution's fee certificate needs to be submitted to the employer.

For making PF withdrawal before retirement: An employee who is 54 years of age and due for retirement in one year's time can apply for withdrawal of 90% of the total amount (employee and employers) by submitting form 31 along with an employer-issued the certificate stating the retirement date.

For making an EPF withdrawal in case of closure of employee's employing establishment: In this case, an employee will be only applicable if the employee has not received the wage for two months or more or if the lockout or closing has been stretched beyond 15 days, irrespective of tenure of service. For a lockout period beyond six months, an employee can avail the advance from the employer's side of the account too.

EPF Form 10D:

This form can be used for applying monthly pension under employee pension scheme by employees who are over 58 years of age and have completed ten years of service. There are various types of pension which can be claimed through this form:

Superannuation form

Reduced pension

Disablement pension

Widow and children pension

Orphan pension

Nominee pension

Dependent parent

Get your free Credit report that cost

Rs 1200 for FREE1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

EPF Form 13:

This form can be used for transferring the balance from old EPF account to new one.PF contributions are sent to trust, and details of employee's service are forwarded to the EPFO while making the transfers.

Here are the few points which need to be kept in mind:

1. Form 13 consists of Part A, B and C.

Part A consists of personal information, Part B- consists of old PF account details and Part-C consists of current PF account details.

The old and new EPF accounts need to be explicitly mentioned, in case the establishment is not under the purview of EPF scheme,1952 then Pension fund account details need to be provided.

The form has to be signed by the new or old employer.

The form has to submit to relevant Employer's EPF office, depending on who attests the form.

When 10 C and 10 D Form can be submitted with Form 19??

While applying for withdrawing EPF balance through Form-19, an application need to be made for pension scheme certificate through Form 10 C or Form 10 D depending on age and numbers of years service completed.

If the member is below 50 years of age:

If 10 years have been completed, then Form 19 and 10 C need to be submitted for pension scheme certificate.

If 10 years service is not completed,then also Form 19 and 10C need to be submitted for pension scheme certificate or withdrawal benefit.

For members between 50-58 years of age:

If 10 years service completed-Form 19 and 10C, and Form D for the reduced pension.

If 10 years not completed then also Form 19 and 10C need to be submitted for pension scheme certificate or withdrawal benefit.

For members above 58 years of age:

If 10 years service completed: Form 19 and Form 10D for pension.

If 10 years service not completed, Form 19 and Form 10C (For pension scheme and withdrawal benefit)

Note: Members who have not completed 10 years tenure can retain the membership of Pension fund but can enjoy the withdrawal benefits only after completion of tenure.

EPF Form 20:

This form needs to be submitted for EPF final settlement in case of death of an employee or the member.

For members below 58 years of age:If they are still in service, Form 20 and 10 D for monthly pension and Form 51 for an insurance claim.

For members above 58 years of age:

If ten years completed: Form 20 and 10 D for monthly pension and Form 51 for an insurance claim.

If ten years not completed: Form 20 and 10 C( for monthly pension) and Form 51 for an insurance claim.

Get your free Credit report that cost

Rs 1200 for FREE1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

PF Form 11-(New) Declaration form:

This form is to replace Form 13 in case the employer has verified KYC details through digital signatures for PF account transfer request.

Transfer of EPF account online and offline:

Offline method

Fill the form 13 and get it attested from the past or present employer to submit further.

Submit the form to the relevant regional EPF office and the PF contributions from old account will be transferred to the trust.

The employer needs to submit Annexure K which will indicate employee's tenure of service and PF account balances to Regional Provident Fund Commissioner in Regional EPF office.

After the verification of the annexure K, PF trust will complete the procedure through NEFT, after which the balance will be transferred from old account to employee's new account.

Online Method:

For transferring EPF account online from previous to present employer, Employee needs to visit EPFO website or portal at www.epfindia.gov.in.

The first step involves the verification of registered digital signatures of previous and past employers if the employers don't have digital signature then use the offline method.

Choose the option of Online Transfer claim portal on EPFO page.

Check the eligibility of filing transfer claim online.

For checking the eligibility of OTCP, provide the old and new EPF account numbers.

Login the details filling the document type and mobile number which will lead to online transfer claim Application.

Put the request for claim transfer under the claim option.

Different forms will be displayed on the screen for putting request of transfer of account.

Choose the form as per the process requirement and get it attested by the previous or new employer. Preview the form before the final submission.

Get the pin and accept the declaration . Submit the form for attestation by the employer. Once it will get attested and verified by employer,EPFO will process the amount in the account.

Any grievance issue can be logged in the portal through grievance system.

Online Tracking of EPF claim status:

For the people who prefer online mode, the status of EPF claims can be easily tracked online on EPFO portal under "Know your claim status".Below are the few steps that need to follow:

At EPFO site, click on know your claim status.

Choose your state and the regional EPF office.

Enter the establishment code and sub-code if any, after the region and office codes are displayed on the screen.

Fill the PF account details for submission.

On submission of claims, a claim id will be generated.

Offline tracking method:

Visit the EPFO office and fill the forms manually for submission.

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs