Facts and Fiction of Credit Report

If you haven't been a sensible borrower, your credit score might be a reality check for you. The credit rating plays an important role when you're applying for a loan. If you've got a greater credit rating, you will be at a place to bargain for relaxed terms and conditions and also for a decreased interest rate.

The Characteristics of Credit Report

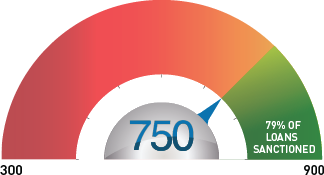

Like many different elements which influence a credit score score, DPD (Days Past Due) is among the most critical ones as it reflects your repayment behaviour. Therefore, it's essential that you assess your credit score at least once a year. You can check your credit score with mymoneykarma. A credit rating above 750 is regarded as a fantastic score and odds are more that your loan application will be approved. Review and enhance your credit score from time to time as a way to prevent unpleasant surprises in the shape of a rejected loan application. You will see that most people who have a high credit score also have the habit of using different types of credit.

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Is It Only the Credit Report that Matters?

In case the credit score is high, the lending institution will explore the application and consider different details to ascertain whether the applicant is creditworthy. If it is in the acceptable range, the lender will consider other details to determine if the applicant is creditworthy. A credit rating and report have come to play an important part in our financial lives.

Your score is just a part of your credit file, which is also called the Credit Information Report. In case the credit score is high, the lending institution will consider different details to learn whether the applicant is creditworthy. Your credit score determines whether you qualify for the new line of credit or not, and what is going to be the rate of interest and your credit limit.

The Battle Over Credit Report and How to Win It

Currently, you can receive a report together with a credit score once annually for Rs. 400-550 from the credit information companies OR you can get your free Equifax credit report from mymoneykarma. The credit score rating can therefore be referred to as a statistical comparison that your prospective lender will appear at during your credit appraisal process, before it decides whether you are worthy of getting more credit.