Goods and Services Tax (GST)

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

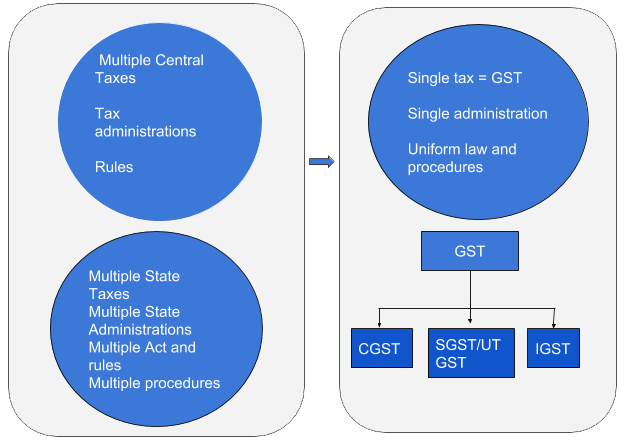

As per article 366(12A), GST or Goods and service tax is an indirect tax in India which is levied on supply of goods or services or both except on the supply of alcohol for human consumption.The purpose of GST is to incorporate multiple indirect taxes that were getting charged from suppliers and consumers by the Central and State government.

Though Goods and Service tax law have been introduced with some unique principles but it also consists of some important components of old Central and State tax laws.It is also influenced by VAT/GST legislations of several countries like European Union,Australia and Malaysia etc in addition to International guidelines of OECD.

NEWS UPDATE

1. The last date for filing GST annual returns of FY 18-19 has been extended till the last week of June, 2020.

2. The last date for filing GSTR-3B - due for March, April, May 2020, and composition returns - has been extended till the last week of June, 2020.

3. There will be no interest, late fee, or penalty for companies with less than Rs. 5 crore turnover; For the bigger companies, interest will be 9%.

4. The last date to opt for a composition scheme has been extended till the last week of June, 2020.

5. The due date for payments under the ‘Sabka Vishwas’ scheme has been extended to June 30, 2020.

Pre GST Structure in India:

The Indirect taxes which were getting charged by the Central Government until 1 July 2017 are Central Excise duty,duties of excise imposed Medicinal and Toilet Preparation Act, additional duties of excise,service tax,Central surcharges and cesses,additional duties of customs(CVD and SAD) while the state taxes which were encompassed in GST are CST,State VAT, Entertainment tax,Purchase tax,Tax on lotteries,luxury tax,state surcharges etc.The constitution has been amended to dispense the coexisting powers to Centre and state for levying GST, where Centre will be imposing GST on sales of goods and States on the provision of services.

Present Indirect Tax Structure

Key Features of GST Law from constitutional Perspective :

The bill was passed by the the Rajya Sabha on 3rd of August,2016 and by Lok Sabha on 8th Of August,2016.

-

Article 246 defines the Concurrent jurisdiction for levy and collection of GST by the centre and the states.

-

Article 269 A specifies that Centre would be responsible for levying and collecting IGST on supplies of inter-state trade and commerce including imports.

-

Clause 19 states compensation would be given to states if they will have loss of revenue for five years on recommendation of GSTC.

-

On recommendation of GSTC, GST will also be levied on petroleum crude,high speed diesel,petrol,natural gas,aviation turbine fuel from a later date.

History of GST in India:

The idea of GST was recommended by the tenth Prime Minister of India, Mr.Atal Bihari Vajpayee in year 2000 for which an empowering committee was formed by state finance ministers to prepare the structure of GST.The representatives from the Centre and the State were urged to study several aspects of the proposal and come up with reports on exemptions,taxation of inter-state supplies,taxation of services.The committee was headed by the Finance Minister of West Bengal, Mr.Asim Dasgupta till 2011 where Mr.Vijay Kelkar between 2002 to 2004, being an advisory to Finance Ministry led the task force for highlighting the problems in the concurrent tax structure and reporting how they can be rectified by adopting GST.

In 2006,the Finance Minister Mr.P.Chidambaram proposed to subsume GST in budget with a long term objective of introducing uniform taxation structure in India after which 1st April,2010 was decided as the date on which GST would be implemented in India.But the empowered committee released first discussion paper in 2009,which became the point of discussion between centre and the states.

In 2012,Congress put forth the bill for implementing GST which drew the disapproval from the other party due to concerns over clause 279B due to which finance ministers of different states held meeting with finance minister of India to resolve all the issues.

In 2013 during the budget session Finance Minister declared that states will be given compensation of Rs 9000 crore as compensation, convincing state finance ministers for co-operating with the government to implement indirect tax regime.

In February 2015 Arun Jaitley, the new Finance Minister declared in budget speech that GST will come in to effect by 1st,April 2016 but to difference between states and parties and other legal issues it was delayed for a year.

On July 2017 four GST related bills became acts with finalised rules and rates.These were Central GST bill,Union territory GST bill,Integrated GST bill,GST bill as compensation to states.

Benefits of GST:

-

Reduction in prices.

-

Reduction in Cascading of taxes.

-

Common national market

-

Self regulating tax system.

-

Simplified tax regime

-

Reduction in multiplicity of taxes.

-

Benefits to small taxpayers.

-

Non intrusive electronic tax system

GST Calculator:

Its an effective tool to determine the tax value applicable to commodity and services and to calculate the value of product and services.

GST amount= (Original price*GST rate)/100

Net price=Original price + GST amount

For removal of GST:

GST amount= Original price- (Original price * 100/(100 + GST rate)

Net Price = Original price- GST amount

Role of CBIC (Central board of Indirect tax and customs) in GST:

-

Drafting of GST rules and procedures-CGST,UTGST and IGST laws.

-

It is responsible for the administration of IGST and CGST laws.

-

Levy and collection of custom duties.

-

Training of officials of both Centre and states.

-

Assessment ,anti-evasion and enforcement under CGST,IGST.

-

Provides training to centre and states.

GST Rates

GST rates are assigned to various goods and services by the GST Council. There are some products which can be bought without GST, but there are most others which have GST amounting to 5%, 12%, 18% and even 28% GST of the original price. The GST rates for goods and services have been changed from time to time since the new tax laws were introduced in 2017. In February 2020, the GST council meeting was chaired by the Union Finance Minister.

Here are the GST percentages of some items:

|

Name of item |

Applicable GST rate |

|

Mobile phone |

18% |

|

Sanitizer |

18% |

|

Gold |

3% |

|

Steel |

18% |

GST Registration using the GST portal

Here are the steps for GST registration from the official GST portal for all taxpayers.

-

Record your GSTIN and registered mobile number

-

Go to ewaybill.nic.in

-

Click on “E-way bill registration” if you are a first time taxpayer

-

Enter your GSTIN number and click on Go

-

You’ll be taken to a page where your details like email address and phone number shall be auto-filled. Here you need to select the Send OTP option to get the OTP on your cell phone. Verify the number.

-

When verified, you’ll need to give your preferred user ID to operate the account with.

-

Lastly, create a password.

GST Returns

A GST Return is a document that has information about the income to be filed by a taxpayer. This information is there to find out a taxpayer liability to pay tax. Under the GST ACT, all registered dealers need to file their GST returns along with purchase, sales, input tax credit, and output details. All businesses need to file every second month as well as annually.

GST Certificate

This is the official document issued by the concerned authorities for businesses enrolled under the GST system. Businesses with turnovers of Rs. 20 lakh or more than that, and some special businesses need to register under the GST system. If you are a taxpayer, you can get the GST form from the GST official website. The certificate is not for physical use, but is only digital. The document contains the GSTIN, trade name, legal name, constitution of business, date of liability, address, period of liability particulars of approved authority, types of registration, signature, approving authority’s details, and date of certificate’s issue.

Types of GST

Based on the transaction’s type, there are 4 types of GST. They are:

-

Central Goods and Services Tax or CGST- This is levied on the intra supply of goods and services. This tax is governed by the Central Goods and Services Tax Act and levied by the central government. This tax replaces all previously applicable customs duty, central excise duty, service tax, CST, SAD and others. This tax is for taxpayers to be paid along with SGST.

-

State Goods and Services Tax- Just like CGST, SGST is also charged on the sale of services and products within a state. It replaces entry tax, entertainment tax, VAT, cesses, state sales tax and surcharges. The revenue collected thus goes to the state government.

-

Integrated Goods and Services Tax- IGST is charged on the interstate goods and services transactions between states as well as on imports. The money is collected by the Central government but is distributed among the states.

-

Union Territory Goods and Services Tax- UTGST is the tax on supply of goods and services on an union territory.

What is GSTN?

The fill form of this is Goods and Services Tax Network. It is responsible for the management of the IT system in regards to GST portal.

Features of GSTN

The work of the GSTN includes:

-

Handling invoices

-

Handling registrations

-

Handling payments and refunds

-

Handling various types of returns

Functions of GSTN

Its main functions include:

-

Handling invoices

-

Handling registrations

-

Handling payments and refunds

-

Handling various types of returns

GST Helpline

If taxpayers have any confusion on doubts regarding their GST filing, they can get in touch with the authorities directly through the GST helpline: https://selfservice.gstsystem.in/

News Updates

21 states have chosen the Borrow option to avoid their GST dues

As of 21st, September 2020, 21 states in India have chosen to borrow which has been proposed by the GST tax council. It was done to meet the shortfall in compensation in the middle of the pandemic from the center. The states have chosen Option 1 or Borrow, which allows them to borrow up to the tax collection shortfall, a sum estimated at Rs. 97,000 crore.

The other option allows them to borrow a compensation package of Rs. 2.35 lakh crore.

GST e-Invoicing now compulsory from October 2020

As on July 20th 2020, the government has decided to gradually introduce mandatory GST e-invoicing from the 1st of October. This shall be mandatory for those businesses that have a turnover of Rs. 500 or greater.

18% GST on all hand based sanitizers

This year, there shall be a GST of 18% on all hand-held sanitizers, according to the AAR or Authority for Advance ruling.

GST June Collections reach Rs. 90,917 crore

GST collection for June 2020 has reached Rs. 90,917 crore gross. This is however 9% lower than the same period last year. However, this is higher than that in the Month of both April and May 2020.

Small taxpayers shall not be charged interest on GST

Small taxpayers who average a turnover of Rs. 5 crore shall get a waiver of their late fees and interest, provided they fild the form GSTR-2B for all supplies affected during May, June and July. This needs to be done by September. Till 6th July, such taxpayers won’t have to bear the burden of paying interest for late filing of GST returns. Interest rate is reduced to 9% as well till 30th September.

®

®